CPA firms will be in a great position to help their small business clients with the latest round of the Paycheck Protection Program, according to Barry Melancon.

The latest round of coronavirus stimulus legislation includes some major tax provisions and changes for accountants to watch out for in the New Year.

The American Institute of CPAs has joined with over 560 business and trade organizations in urging Congress to pass legislation.

With a CARES Act fix stalled along with stimulus legislation, the institute is urging CPAs to put pressure on their representatives.

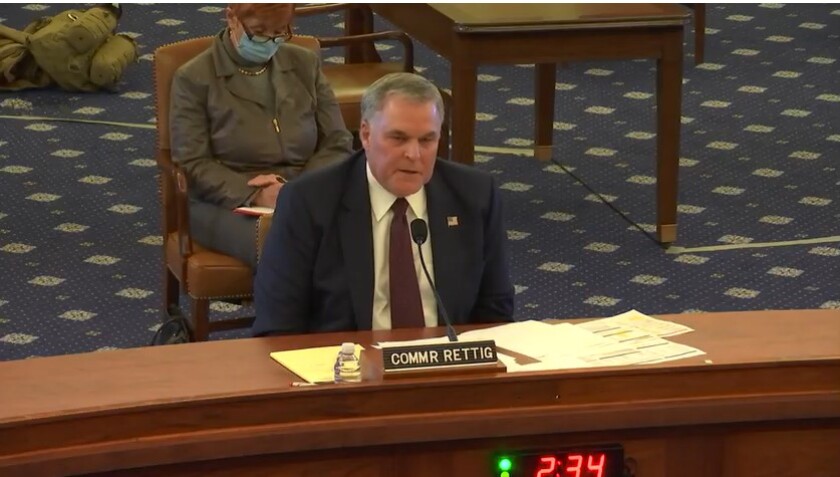

The American Institute of CPAs is firing back after a congressional hearing, asking for penalty relief for taxpayers dealing with the pandemic.

The guidance clears up the tax treatment of expenses when a loan from the Paycheck Protection Program hasn’t been forgiven by the end of the year.

Financial satisfaction of people in the U.S. bounced back strongly in the third quarter, reversing the lows brought on by the coronavirus.

The document discusses some considerations involving the use of specialists when auditing financial statements during the pandemic.

Most companies don’t expect to reduce their office space in the coming year.

The AICPA believes taxpayers will be able to avoid penalties if they write “COVID-19” at the top of their return.