As lenders scale up on their remote capabilities in response to the pandemic, the software companies that service them see exponential growth.

Researchers predict that the rate will rise in step with unemployment rate projections.

While the mortgage market began the year healthy, lenders and borrowers need to prepare for the impacts of the coming coronavirus recession.

Mortgage industry technology providers are adjusting their processes to allow for originations to keep flowing through the system as the nation combats the coronavirus.

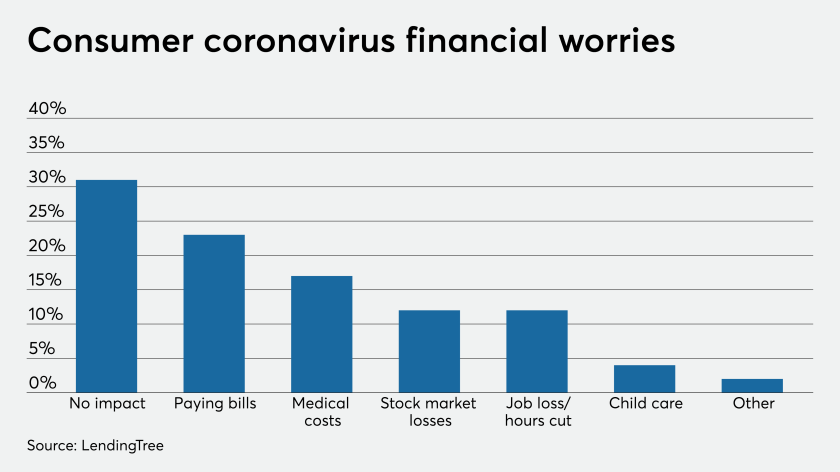

Fears stemming from the coronavirus have resulted in lower mortgage rates and more business for now, but if the situation deteriorates further, consumers could decide to put off buying a home.