If the Federal government doesn't help, the $12 billion plan could be funded by the city selling "relief bonds."

The municipal finance industry is dealing with minute-by-minute news of state-wide school closures, shuttered restaurants, curfews and canceled events. New issues are increasingly being put on the day-to-day calendar.

The comptroller, citing projected losses in entertainment and tourism while the city is virtually closed, called for a savings target of 4% of tax levy-funded agency spending.

How severe a financial hit New York City will take during the COVID-19 pandemic is as much of an unknown as the degree of virus spread.

Chairman Patrick Foye says that the outbreak has no material effect for now, and the authority promises to continue timely disclosure.

It was a busy day in the primary, as the markets continue to deal with crosscurrents of COVID-19 and election results.

Looming state budget cuts combined with the COVID-19 threat could have a negative impact on NYC's economy.

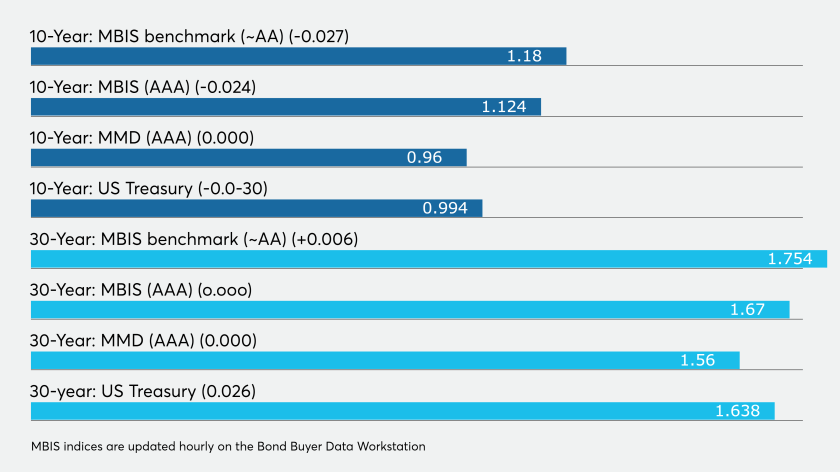

Issuers tapping the market in uncertain times, but with certainty of low rates.

With each passing day, fears surrounding COVID-19 elevate as the equity sell-off pressed on. The biggest winners have and will continue to be muni issuers, as they are selling into a record low rate market.