Discover is working to help Black-owned businesses and other merchants maintain foot traffic — safely — through the use of the card network's payments technology and its marketing heft.

The major card networks have heavily invested in broader services as transaction processing loses its luster, a strategy that’s provided a ray of hope as retail and travel industries remain sidelined.

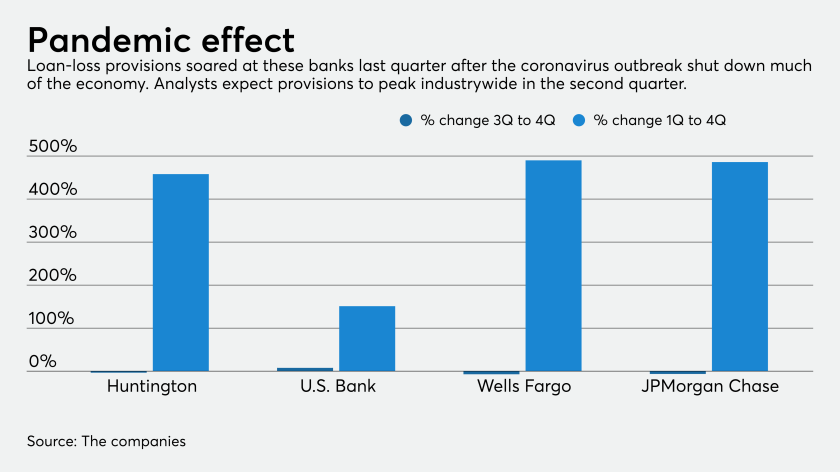

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

Discover transitioned all of its 8,000 U.S.-based call center personnel to work from home within a matter of days after the U.S. declared a national emergency on March 13. By March 20, Discover had 95% of its agents working from home using a thin-client device to emulate their call center desktops.

It was less than three months ago, though it seems like a lifetime. Mastercard CEO Ajay Banga welcomed progress in the trade dispute between the U.S. and China, but with a caveat. The good news wouldn't last if the coronavirus became a pandemic.

With the world gripped in panic over the rapid spread of the coronavirus — and the stock market falling in response — payments companies have been left to speculate on what it all means to their operations in an increasingly global economy.