- 3 Min Read

In separate letters to Congress, the Fed asked for legislative action to ease Tier 1 capital minimums while the FDIC said it may use its own authority to address the market strain on banks.

2 Min ReadThe Main Street Lending Program, announced on April 9 as an option to help U.S. businesses weather the coronavirus outbreak, will be available to a wider array of companies than previously planned.

3 Min ReadThe mass transit authority cannot tap the Municipal Liquidity Facility directly, chief financial officer Robert Foran said.

3 Min ReadThe Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

4 Min ReadGroups representing dealer firms and issuers both weighed in positively Monday evening after the Fed’s afternoon decision that it will expand its Municipal Liquidity Facility in both scope and duration.

1 Min ReadThe central bank expanded the reach of the program as pressure mounts on the government to support localities struggling economically because of the coronavirus pandemic.

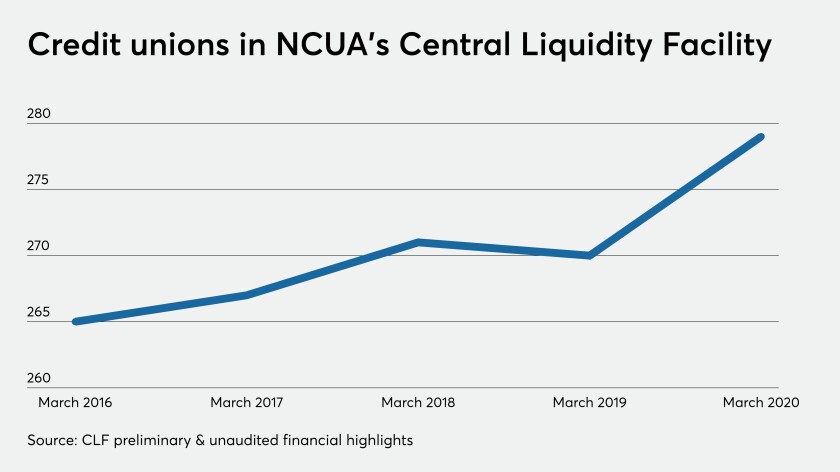

6 Min ReadA credit union-specific liquidity backstop is far less popular than other options such as the Federal Reserve's discount window. The National Credit Union Administration wants to change that.

1 Min ReadThe central bank said customers will be able to make more transfers and withdrawals "at a time when financial events associated with the coronavirus pandemic have made such access more urgent."

1 Min ReadThe central bank and other agencies have come under pressure to be transparent about their use of funds authorized by the recent pandemic rescue law.

5 Min ReadThe Federal Reserve’s Main Street Lending Program is meant to be a lifeline for midsize businesses, but two weeks after its unveiling, those firms and their lenders remain on edge about what strings will be attached.