JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

Latest News4 Min ReadThe move is part of the effort by banks and other companies to promote racial equity and be more sensitive to the stresses on front-line employees.

4 Min ReadBill Clerico created WePay during the last financial crisis, and sees a similar opportunity now. The coronavirus pandemic is affecting different markets in vastly different ways, and easing the flow of capital is just one way to provide help.

7 Min ReadThe Federal Reserve, U.S. Mint and financial industry representatives are strongly considering a public call for Americans to deposit their spare change, among other fixes, to get coins circulating again. Meanwhile, banks of all sizes are getting creative at the local level.

5 Min ReadThe Fed has already eased certain capital requirements in response to the coronavirus pandemic. It should avoid making any further adjustments to the surcharge, which is meant to keep global banks from creating systemic risks.

8 Min ReadThe days of meeting with mentors and pitching investors in person are at least temporarily over, but fintech incubators, accelerators and boot camps are finding creative ways to replicate these valuable experiences online.

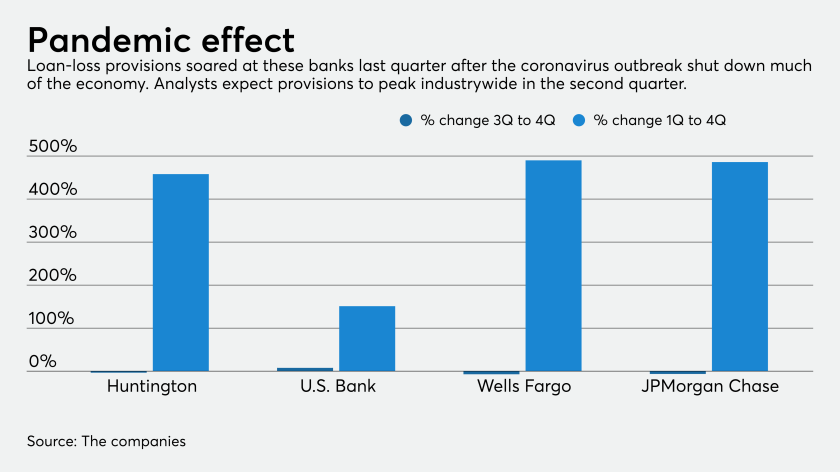

7 Min ReadLenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

5 Min ReadThe lines of white cooling trailers that silently announce the scale of the tragedy are what lockbox employees at JPMorgan Chase see on their way to work.

4 Min ReadJennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.

4 Min ReadConsumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

2 Min ReadThe nation's largest bank is temporarily reducing its exposure to the mortgage market amid rising unemployment and estimates that home prices could drop by 10%.

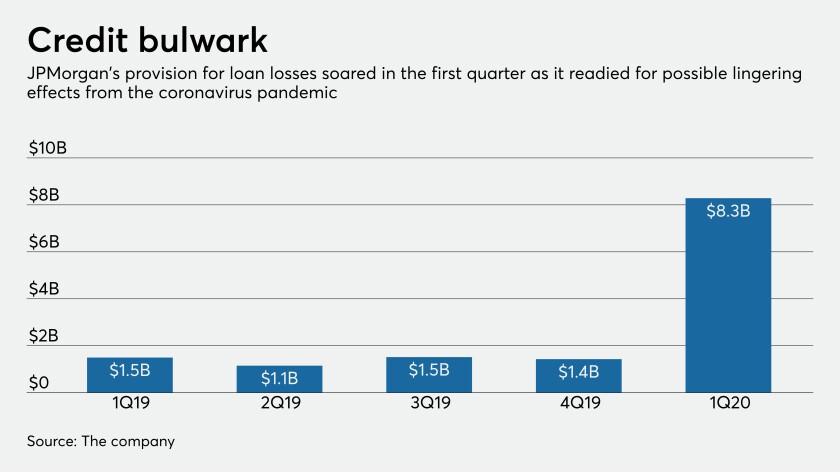

4 Min ReadThough hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

4 Min ReadFew lenders are finding creative ways to provide much-needed financial advice and emergency services online.

2 Min ReadJPMorgan Chase, Wells Fargo, Citigroup and U.S. Bancorp, along with 200 state-chartered banks and credit unions, have agreed to let borrowers skip payments for 90 days if their finances have been upended by the pandemic.

1 Min ReadThe company's bank tellers, call-center workers and support staff are part of the roughly 70% of American workers who don’t have the ability to work from home.

4 Min ReadMore firms are taking stringent measures to protect employees and clients.

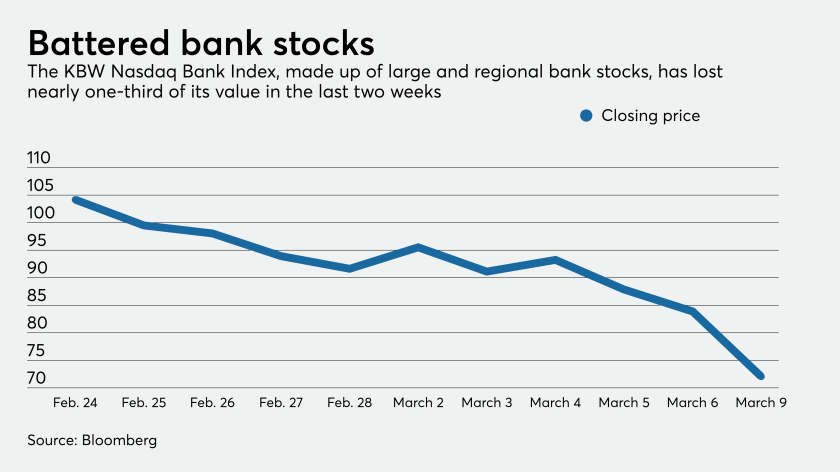

4 Min ReadConcerns about the economic fallout of coronavirus have mostly focused on supply chain disruptions. But fears are growing that weakening consumer demand could spark a recession.

1 Min ReadThe Massachusetts senator and presidential candidate sent a letter to CEOs of five of the largest U.S. banks asking about their response to the outbreak.

5 Min ReadAs the COVID-19 virus spreads globally, many U.S. financial institutions are said to be taking steps to protect employees and minimize disruption. But only a handful are sharing specifics, to avoid contributing to any public panic.

1 Min ReadA recent sale-tax hike in the country and the impact of the coronavirus have driven the yen to it's biggest two-day drop since 2017.