With assets of over $170 billion, Ohio-based KeyCorp's bank footprint spans 16 states, but it is predominantly concentrated in its two largest markets: Ohio and New York. KeyCorp is primarily focused on serving middle-market commercial clients through a hybrid community/corporate bank model.

Latest News5 Min ReadNoninterest income has bolstered profits this year. But its growth is expected to slow over the next two years, making for a gloomy earnings outlook unless vaccine distributions and the economic recovery are relatively swift.

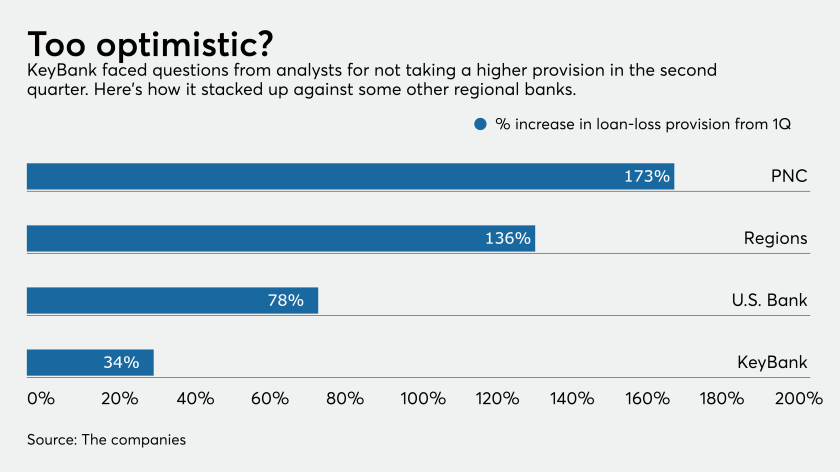

3 Min ReadOther regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

7 Min ReadMany banks are slashing their spending. Others are changing their messaging strategies. And those banks that partner with pro sports teams are stuck in limbo, since it remains unclear when games will resume.

4 Min ReadConsumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.