The company's results put firm numbers on one of the most discussed business trends of the pandemic economy — the acceleration of digital payments.

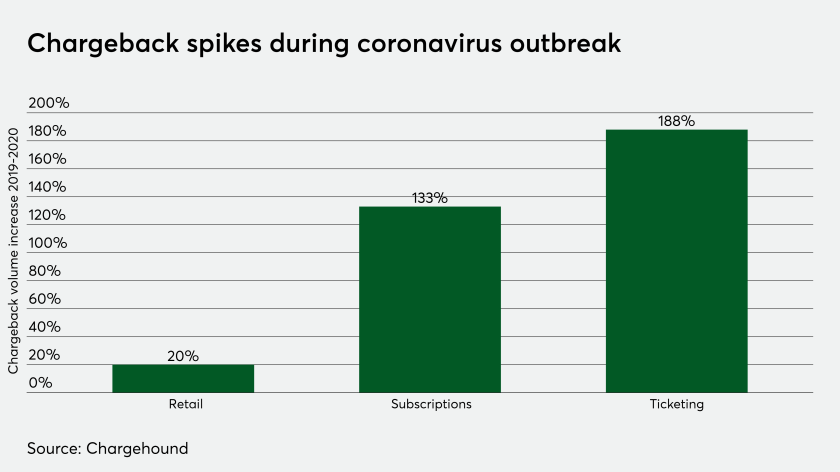

As credit card chargebacks accumulate during the coronavirus crisis from consumers seeking reimbursement for canceled trips and events, PayPal is extending an olive branch to merchants.

Despite PayPal's efforts to get people to receive — and spend — their stimulus checks from PayPal accounts, the coronavirus pandemic caused its revenue for the first quarter to come in below company guidance.

PayPal, Intuit QuickBooks Capital and Square Capital have been named direct lenders in the Paycheck Protection Program, and more await the go-ahead. They could be crucial to reaching the smallest firms trying to survive the economic toll of the coronavirus pandemic.

Online platforms and apps can be utilized to quickly support small businesses and consumers facing unexpected financial hardship.