The release of the SBA's loan forgiveness application highlights the questions that remain around the Paycheck Protection Program.

The Treasury Department and the Small Business Administration released an interim final rule after posting the loan forgiveness application.

Jennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.

The U.S. Small Business Administration, in conjunction with the Treasury Department, released a loan forgiveness application for the SBA’s troubled Paycheck Protection Program, along with detailed instructions for the application.

Padgett Business Services’ Roger Harris suggests some exceptions for employers with fewer than 50 staff.

We have all spent so much time and energy applying for the Paycheck Protection Program, trying to interpret and decipher the intent behind the words.

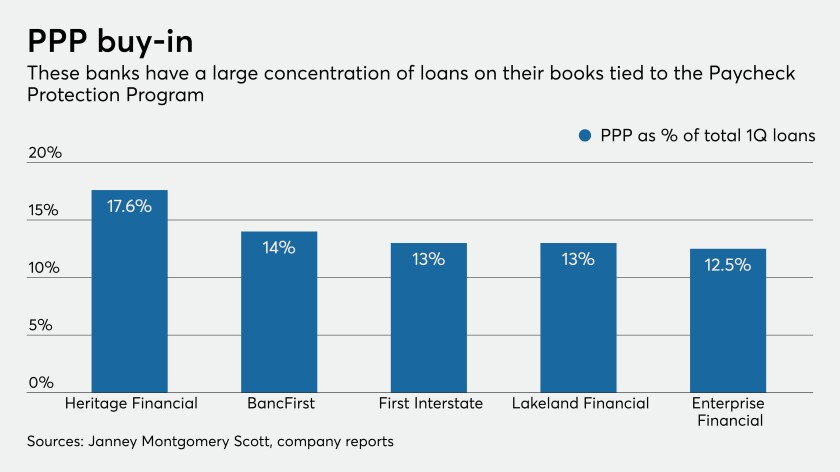

Banks could end up holding many low-rate Paycheck Protection Program loans on their books for two years, and dealing with irate borrowers who failed to meet federal requirements for forgiveness.

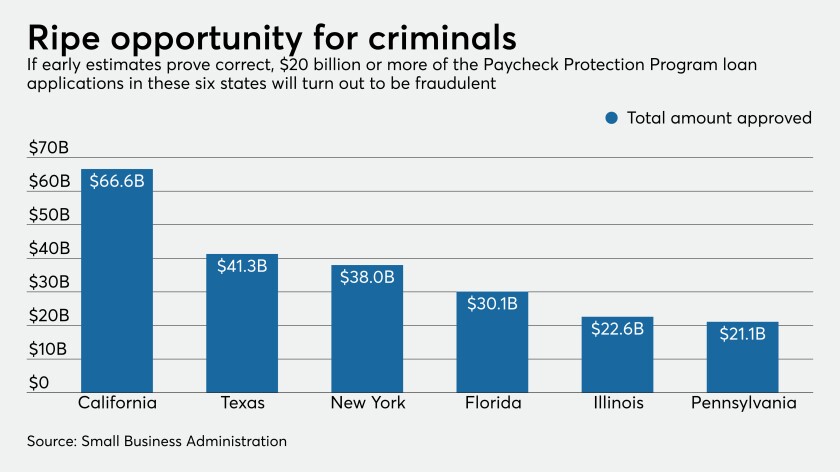

Up to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

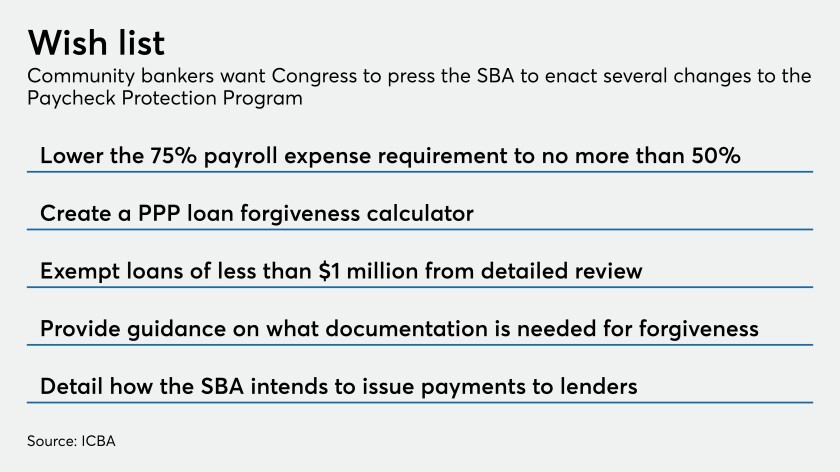

Regulators need to give more detailed guidance on the coronavirus relief program for small businesses so lenders don’t get trapped in underwriting mistakes down the road.

Bankers are bracing for accusations of discrimination in the way Paycheck Protection Program loans were allocated.