It was a busy day in the primary, as the markets continue to deal with crosscurrents of COVID-19 and election results.

The municipal bond market is in for another action-packed week, with above-average issuance and COVID-19 still spreading rapidly.

Taxable bonds and COVID-19 are two of the main catalysts that helped February municipal bond volume ascend to its highest level since at least 1986.

Municipal market technicals were already driving performance and so the strong quality bid has deepened the rally across the curve as the asset class really didn’t need to grab the U.S. Treasuries coattails all that tightly.

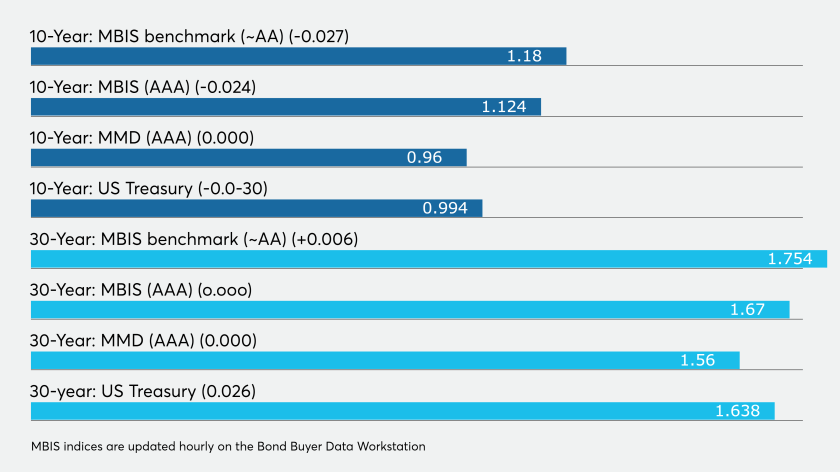

Municipal bond yields were unchanged at record low levels, according to late reads.

As COVID-19 fears run rampant, investors continued to sell off equities, resulting in muni yields again following Treasury yields down to all-time lows.