Sales tax collections fell 13.2% compared to the same month last year, the steepest decline since January 2010

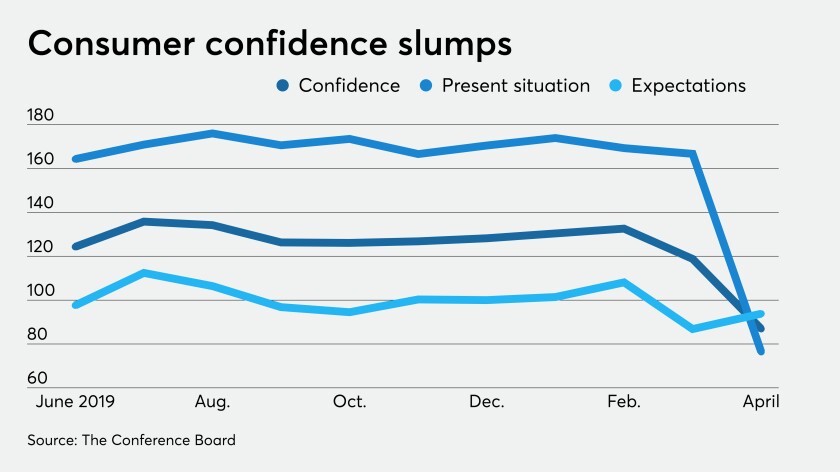

Pessimism about the economic situation in the United States continues to affect the way consumers view the economy and their financial position.

Sales taxes are a pillar of the Texas state budget, and the usually stable revenue source has taken a hit from the COVID-19 pandemic.

Municipal bond issuance was $67.88 billion after the first two months of 2020 and was on pace to easily eclipse the $400 billion mark — then COVID-19 completely turned the market upside down.

The municipal market was hammered Wednesday by the COVID-19 pandemic with a more than quarter point correction in AAA benchmarks, issuers pulling deals off the shelves and more reports of pricing and evaluation confusion.

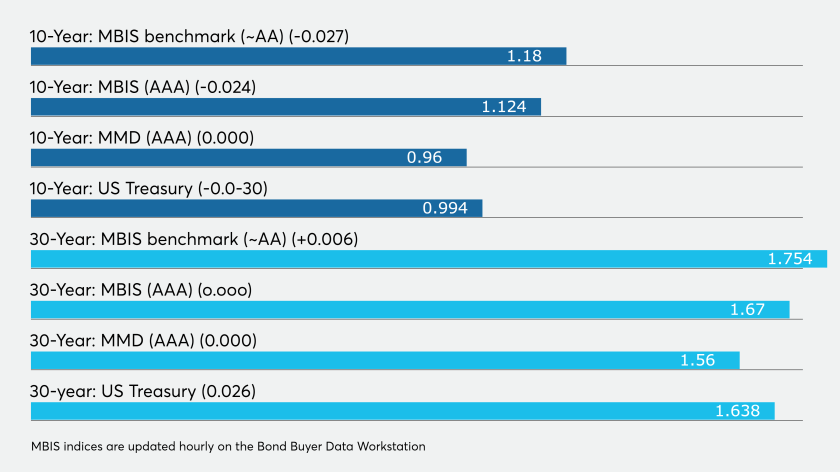

As fear and uncertainty over COVID-19 rapidly grow, it has sent yields for both municipals and Treasuries to never before seen low levels — begging the question if we could see zero or negative yields here in the States?

The world remains on edge about the rapidly spreading COVID-19 and those fears once again have Treasury yields digging down even deeper. COVID-19 fears have now impacted fund flows, as municipals suffers outflows for the first time in 60 weeks.

It was a busy day in the primary, as the markets continue to deal with crosscurrents of COVID-19 and election results.

The municipal bond market is in for another action-packed week, with above-average issuance and COVID-19 still spreading rapidly.

Taxable bonds and COVID-19 are two of the main catalysts that helped February municipal bond volume ascend to its highest level since at least 1986.