The Term Asset-Backed Securities Loan Facility is just one example of a fund that could be retooled.

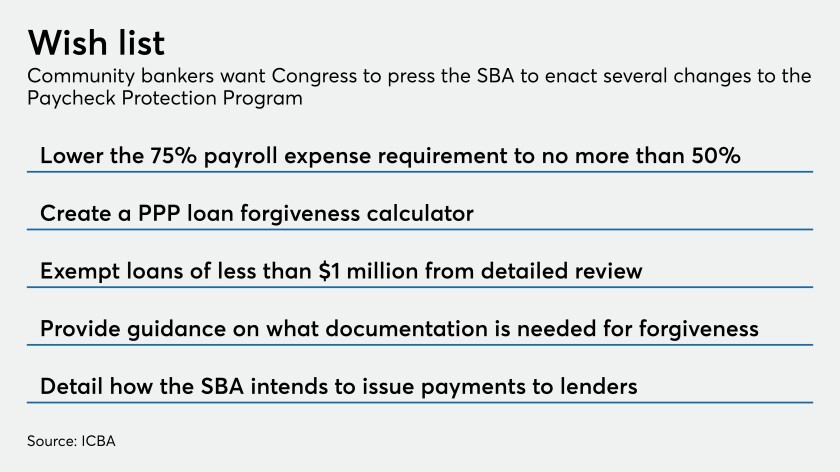

Banks could end up holding many low-rate Paycheck Protection Program loans on their books for two years, and dealing with irate borrowers who failed to meet federal requirements for forgiveness.

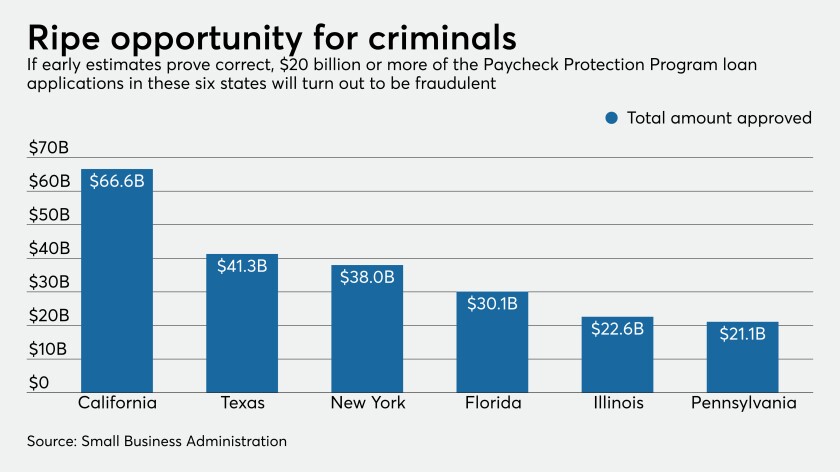

Up to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

The decision, prompted by requests from a bipartisan group of lawmakers, reverses previous IRS guidance.

The Internal Revenue Service said individuals who got a $1,200 stimulus payment intended for someone who’s deceased or incarcerated should return the money but left open the question of how the agency would enforce that.

Millions of Americans have yet to receive their stimulus checks, leading progressives to demand reforms improving underbanked consumers’ access to the financial system.

As special IG for the Treasury’s allocation of $500 billion in aid, Brian Miller could look into funding for Fed credit facilities. But Democrats on the Senate Banking Committee questioned his independence.

Leaders of Congress’s tax-writing committees want employers to be able to continue providing health insurance to their furloughed employees and still qualify for tax credits.

The U.S. Treasury Department is planning to instruct people whose deceased relatives received coronavirus stimulus payments to return the money to the federal government, according to a department spokesman.

As banks accept new applications for the paycheck program, they are dogged by complaints that they prioritized wealthy borrowers. But lenders likely fast-tracked clients they knew best under difficult circumstances, observers say.