Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

Latest News3 Min ReadWhen it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

2 Min ReadThe company has established a fund that will provide capital, technical assistance and long-term recovery support to small businesses, especially minority-owned companies. The other megabanks are expected to donate their fees, also.

5 Min ReadIn a new twist on an old scam, cybercriminals have tried to get thousands of people to surrender their Wells bank account information by sending authentic-looking emails containing malicious links that lead to a fake website bearing the company's name.

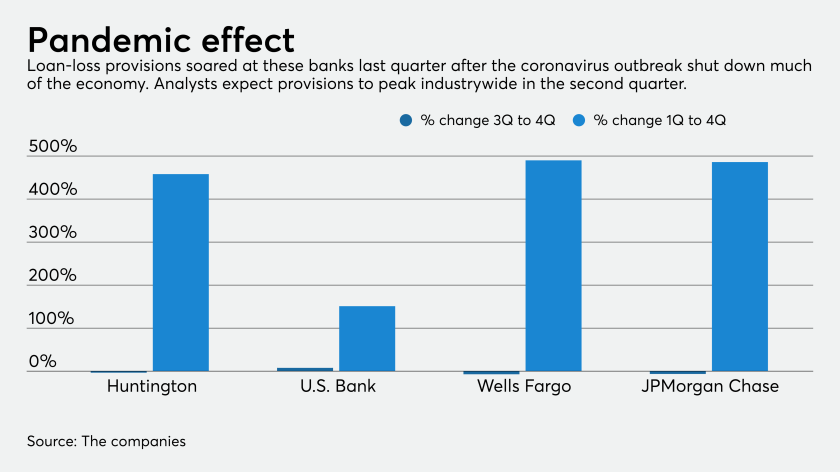

7 Min ReadLenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

2 Min ReadEven after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

8 Min ReadSaul Van Beurden's team is tasked with keeping systems running during the pandemic, including driving equipment to homebound workers. Yet the bank must continue making upgrades demanded by regulators, investing in new technology and recruiting top talent, he says.

5 Min ReadU.S. Bancorp, Wells Fargo, WSFS and others were already deeply engaged in digital transformations before the coronavirus crisis led them to pivot — quickly.

6 Min ReadUse of banks' mobile apps and websites has risen about a third since the coronavirus crisis began, according to J.D. Power.

7 Min ReadLarge institutions say their strong capital positions allow them to reward investors, and the Fed agrees. But critics say this is the time to be preparing for a sharp downturn and continue helping those hurt by the coronavirus pandemic.

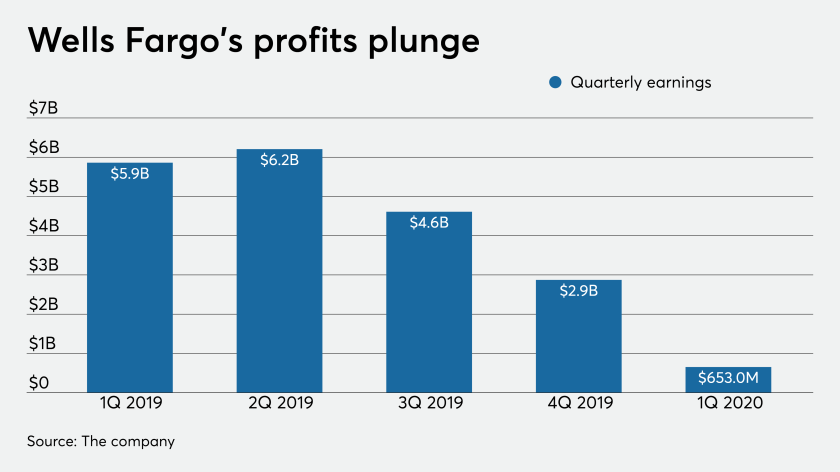

4 Min ReadIts prediction that business conditions will remain weak this year — and into next year — stands in stark contrast to forecasts from political leaders that the economy will rebound quickly from the coronavirus pandemic.

2 Min ReadNearly everything fell during the difficult first quarter: net income, advisory assets, IRA assets, and advisor headcount.

2 Min ReadJust days after the Fed lifted Wells Fargo's asset cap so it could make more Paycheck Protection Program loans, it warned customers its queue is long and they may want to go elsewhere before program funds are exhausted.

2 Min ReadJPMorgan Chase, Wells Fargo, Citigroup and U.S. Bancorp, along with 200 state-chartered banks and credit unions, have agreed to let borrowers skip payments for 90 days if their finances have been upended by the pandemic.

2 Min ReadSen. Sherrod Brown of Ohio, the top Democrat on the Banking Committee, said financial institutions "need to be investing in their communities right now, not investing in their CEOs’ stock portfolios.”

6 Min ReadKathy Kraninger was grilled about whether her agency and others were doing enough to cushion consumers from the economic blow of the coronavirus crisis.

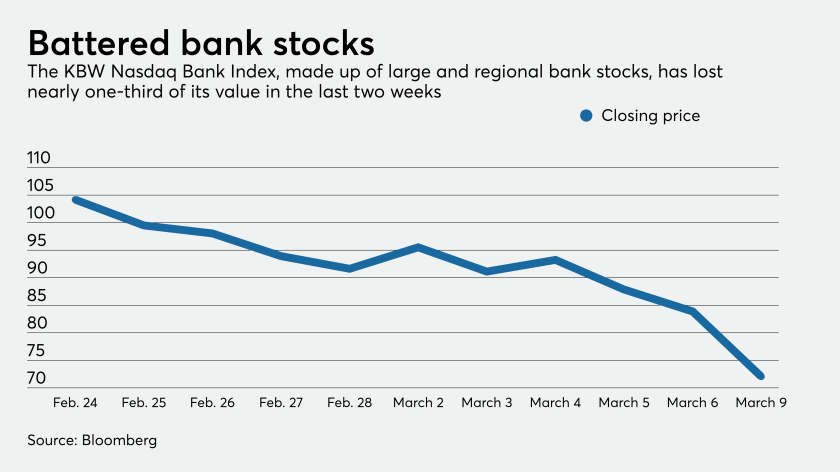

4 Min ReadConcerns about the economic fallout of coronavirus have mostly focused on supply chain disruptions. But fears are growing that weakening consumer demand could spark a recession.

1 Min ReadThe employee “is at home while their health is being closely monitored by their doctor and public health authorities,” a spokeswoman for the bank said.

6 Min ReadWith health organizations warning of a global outbreak, banks are starting to assess the risks to their bottom lines.

3 Min ReadThe bank agreed to pay $35 million to settle SEC charges it recommended high-risk ETFs to some customers; coronavirus fears continue to batter financial shares.

![“I don’t think … [halting dividends] is appropriate this time,” said Fed Chair Jerome Powell. But his predecessor, Janet Yellen, said holding on to income gives banks a “buffer” to further ”support the credit needs of the economy.”](https://arizent.brightspotcdn.com/dims4/default/48f7bb8/2147483647/strip/true/crop/3998x2667+0+0/resize/840x560!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F40%2Fb4%2F76873fe44e4599186506d287c6be%2Fpowell-jerome-yellen-bl-041720.jpg)