Coronavirus has taken a massive toll on suppliers, and emerging invoice methods are getting thrust into the mainstream to rescue cash-strapped businesses.

“There has been an intense fight for liquidity and cash across supply chains,” said John Cochran, a partner in the Los Angeles office of Lovell Minnick, a private equity firm. “The supply chain programs that are in place aren’t enough to address the long tail of supplies.”

The virus has resulted in a supply chain shock on several levels. Some firms are closed, creating gaps in the chain that interrupt work elsewhere. If that work can’t get done, basic long-term initiatives such as gas station upgrades can’t happen on time. The firms that perform these upgrades and other projects also can’t pay, or get paid.

Cochran, who’s charged with anticipating where fintech’s going to go, predicts that the supply chain crisis will force companies into payments technology that supports creative financing.

In the overall technology industry, valuations will come down at least in the short term, though firms that can offer an easy path to upgrade transactions, payment processing or links to other business functions will fare better.

“Given some of the fancy valuations that some of these companies had, the definition of ‘unicorn’ will undergo a change,” said Sanat Rao, chief business officer and global head of Infosys Finacle, adding existing technology positions a firm well to innovate moving ahead. “The firms that will come out of this are the ones that have had little or no question about their digital strength.”

For payment technology firms, it’s not enough to digitize the transaction or make it easier. It’s also necessary to use digital payments to fix financing gaps that are springing up because of the supply chain problems.

President-elect Joe Biden will seek a deal with Republicans on another round of COVID-19 relief, rather than attempting to ram a package through without their support, according to two people familiar with the matter.

The work-from-home phenomenon has triggered a fresh frustration for U.S. corporations: Americans are blowing the whistle on their employers like never before.

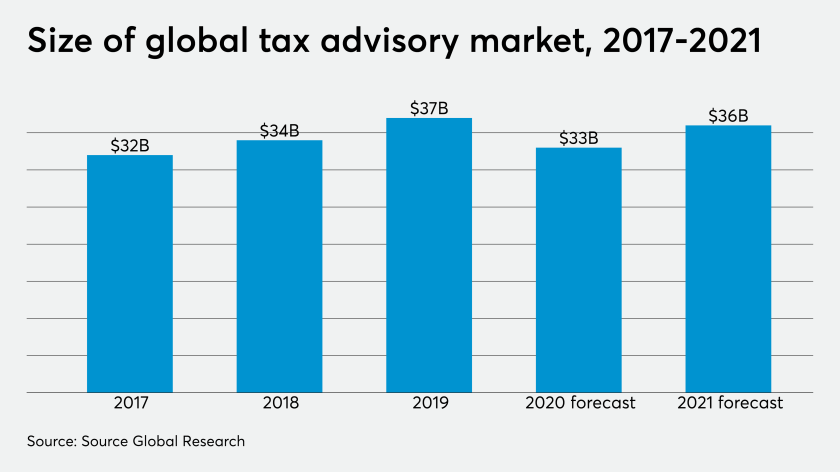

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

“It’s not about the invoice being posted. It’s more about one party stretching from 60 to 90 days because it needs cash now. But the supplier also needs cash today,” Cochran said. “Payments technology will need to be able to deliver that type of financing alternative.”

Lovell Minnick’s focus is on firms in the supply chain space, such as LSQ Capital, a business payments company in the private equity firm's portfolio that mixes invoice financing with faster payments, acting as a middle party that provides fast capital to suppliers with longer terms for buyers. (The VC firm did not disclose unannounced investments.)

As the economic crisis flows through different parts of the economy, the struggles of smaller firms will become amplified because they don’t have the capital reserves to withstand short-term shocks, yet are still important for larger companies that have lengthy supply chains.

“The type of financing LSQ provides has always been there but it’s been driven by the banks for the largest suppliers in most industries,” Cochran said. “But COVID will accelerate the necessity for similar flexibility for small suppliers as well.”

Payments technology firms are expected to fare relatively better than other technology sectors during the economic crisis, with investors recently making big bets on firms such as Stripe and N26, which offers digital payments in addition to automated banking.

In an earlier interview, fintech investor Patricia Kemp, a partner at Oak HC/FT, said partnerships will increase between VC investors and technology firms that have existing relationships. Much of the technology to quickly automate payment flows, such as LSQ’s technology, is being accelerated in an emergency environment. In the case of Stripe and N26, the new investments were dominated by existing venture capitalists.

Lovell Minnick’s portfolio includes BillHighway, a firm that automated payments for associations such as labor unions; Fortis Payment Systems, which offers merchant services, payroll and other business payments; and Currency Capital, which finances equipment loans.

There’s an opportunity for collaboration with and among these firms to address emergency needs with payment automation that will become permanent once the crisis lifts.

“A lot of these associations are nonprofit and volunteer based, and they’ve had a massive disruption to their daily business,” said Trevor Rich, a partner in Lovell Minnick’s Los Angeles office. “They’ve had to automate payments like dues and feels, and a lot of that was paper-based.”

The strategy is to use the payments technology to nudge deeper relationships between the fintechs and clients by integrating payments with enterprise resource planning, according to Rich, who said the opportunity for payment companies is to address the recovery with technology most companies already knew was a good idea.

“If you asked businesses prior to COVID if there is a need to migrate to a digital model, almost all of them would have said yes. But their inaction was the telling point,” Rich said.