Though NFC adoption is still somewhat patchwork in the U.S., new data suggests contactless payment transaction volume is rising during the coronavirus outbreak, giving an advantage to banks and merchants that enabled it early.

Reacting to the public health risk of handling cash and touching payment terminals in stores, many financial institutions and merchants are promoting the use of contactless payments, and banks are starting to see the results.

TD Bank saw contactless transaction volume surge last month following the coronavirus outbreak, providing a bright spot during a bleak cycle, said Angela Conti, the bank's senior vice president of debit cards and payments.

“The number of contactless transactions as a proportion of total transactions jumped in March,” Conti said, noting that while grocery purchases were up, overall card transactions fell as consumers cut travel and other discretionary purchases.

TD Bank has not seen a similar uptick in mobile payments during the coronavirus outbreak. In recent years, the bank’s mobile payments volume has increased steadily year over year — led by Apple Pay — but mobile’s share of overall transactions remains small, Conti said.

Experts estimate 65% of U.S. merchant locations have contactless acceptance, while banks are at various stages of their contactless card rollouts.

For banks and merchants on the earlier edge of contactless adoption — JPMorgan Chase, Bank of America, McDonald's, Walgreens and Starbucks — the transition to a touchless checkout experience during the pandemic has been mostly seamless, though the outbreak exposes some gaps.

The Institute of Internal Auditors is giving corporate America only a modestly better grade on governance in 2020 compared to 2019, and any improvement is probably due to the coronavirus pandemic.

President-elect Joe Biden’s $1.9 trillion COVID-19 relief plan is designed to both pump money into the economy and contain the coronavirus pandemic.

President-elect Joe Biden’s $1.9 trillion economic relief proposal serves as the opening salvo in a legislative battle that could be prolonged by the go-big price tag and the inclusion of initiatives opposed by many Republicans.

One example comes from Apple, which last week dropped the requirement that Apple Card customers must use Apple Pay to qualify for cash-back rewards at Walgreens drive-throughs, MacRumors reports.

To encourage mobile payments, Apple last year launched the physical Apple Card without NFC technology, requiring customers to use Apple Pay via their devices to get 3% cash back at retailers including Walgreens, Uber, Uber Eats, T-Mobile and Nike.

But many drive-through pharmacy and fast-food locations aren’t optimized for the mobile NFC experience, which involves bringing a phone or watch near a payment terminal.

To offset that problem — despite the risk of transferring germs — using the physical Apple Card now qualifies for a 3% cash-back discount at Walgreens drive-throughs through June 30, MacRumors said.

Walmart, as one of a handful of large merchants still not supporting NFC payments, tried to offset its contactless gap during the pandemic by improving its QR code-based Walmart Pay digital wallet. In late March Walmart made a software change to Walmart Pay to create a touch-free checkout experience for customers using its digital wallet, which it touts at its terminals.

Kroger wasn't so lucky. Coronavirus has forced Kroger, another large merchant that eschews contactless payments, to suspend its Kroger Pay digital wallet for in-store checkout. Local store officials said the hand-held devices Kroger offers to scan items while shopping are too hard to clean during the coronavirus outbreak. Kroger was unavailable to comment.

Some merchants sped up planned rollouts of contactless payment in response to coronavirus. Publix Super Markets, which was in the process of gradually converting stores to contactless payments, early this month announced it had completed the rollout to all 1,200 stores.

Many merchants that failed to adopt contactless before are probably rethinking that decision now, said Nathan Hilt, a payments expert at the consulting firm Protiviti, especially considering the success of contactless payments outside the U.S.

“There are two parts to this — existing merchants that have added contactless or can add it; and merchants that should launch now with contactless payments, like drive-through coronavirus testing centers and clinics,” Hilt said.

In the long run, the sudden emphasis on contactless payments during coronavirus could improve growth of mobile payments, Hilt speculated.

“Contactless doesn’t work in all retail environments, but where there’s a benefit, coronavirus is going to accelerate that trend and mobile payments will advance with it,” Hilt said.

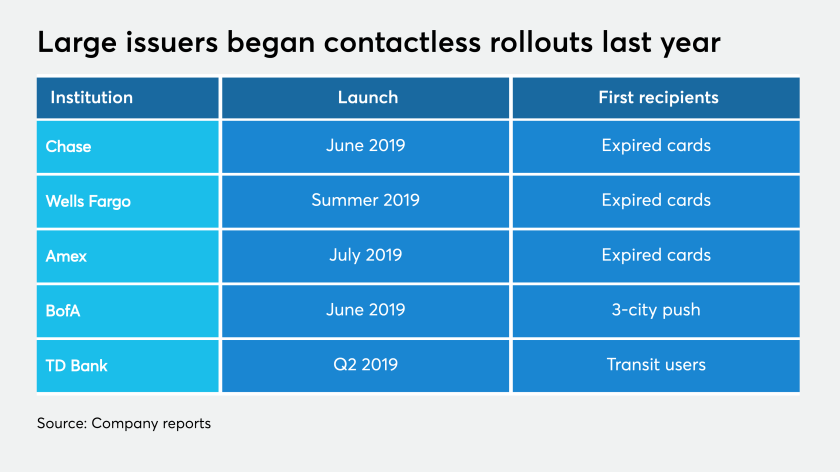

Coronavirus struck at a point when U.S. banks are still only part way through the rollout of contactless cards. Chase in 2018 was the first major issuer to announce plans to begin a broad, gradual rollout of contactless, replacing EMV contact cards with contactless versions as they expired.

Wells Fargo followed with a similar strategy last year, and Bank of America last year dove into mass reissuance of contactless cards in markets where transit systems enabled NFC, with some smaller and midsize issuers moving aggressively to distribute contactless cards. Many are waiting until their existing EMV card stock runs out.

TD is using data to get contactless-enabled cards into the hands of the most likely users. Last year the bank began automatically reissuing contactless cards to any customers who had previously used a credit or debit card to pay for a mass transit ride.

“When transit systems in New York City and other East Coast pockets where we have a large footprint adopted contactless payments, we sent cards to transit riders in those areas,” Conti said.

Currently TD is reissuing contactless cards to customers when existing cards expire, and reserving the option to do mass reissuance to other groups as needed.

“One of the wonderful things about data in payments is that we can see where people are using cards and how they’re spending, so we can be smarter about how and when we equip people with contactless cards,” Conti said.