The skirmish that took place in late March when the National Restaurant Association asked President Donald Trump and congressional leaders to consider cutting interchange fees (also called "swipe fees") on credit cards during the coronavirus outbreak illustrates once again how deeply the disdain for fees for card payment acceptance is embedded in the U.S.

Interchange fees are a major part of the costs merchants pay to accept payment cards. The fees are set by the card networks (Visa, Mastercard, Discover and American Express) for acquiring banks to pay the issuing banks in what amounts to the merchant's bank paying the customer's bank that issued the payment card. Before reaching the issuing bank, those fees are passed onto merchants, who have had some success getting regulators to cap those fees. But those fees remain a point of contention — and a subject of years-long lawsuits — among merchants who feel that they are paying too much for the business necessity of accepting card payments.

While those merchants seek relief from fees during a time in which their businesses face serious damage from stay-at-home edicts because of coronavirus, the credit card companies and banks quickly began to dig in their heels to thwart such a request. However, official word from some card brands began trickling out last week that April updates to interchange would be delayed until July. That's much different than considering significant cutbacks or dropping them overall.

The fact that Visa had already issued a fee update earlier this year signaling that some fees might go down — but fees for card-not-present, mobile transactions and premium cards were going to go up in April — once again opened decades-old wounds over how interchange is determined and whether the process goes against everything a competitive market is supposed to be. And as much as the merchant community demands clarity, the card brands' recent decision to delay until July any changes reinforces the reality that a significant portion of retail is in limbo due to the coronavirus pandemic.

Industry experts question whether interchange fees as we now know them would need to stay in place at their current rate, or even exist at all in the future, as technology advances to either streamline payments processes or allow card networks to change the way they manage transaction traffic.

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

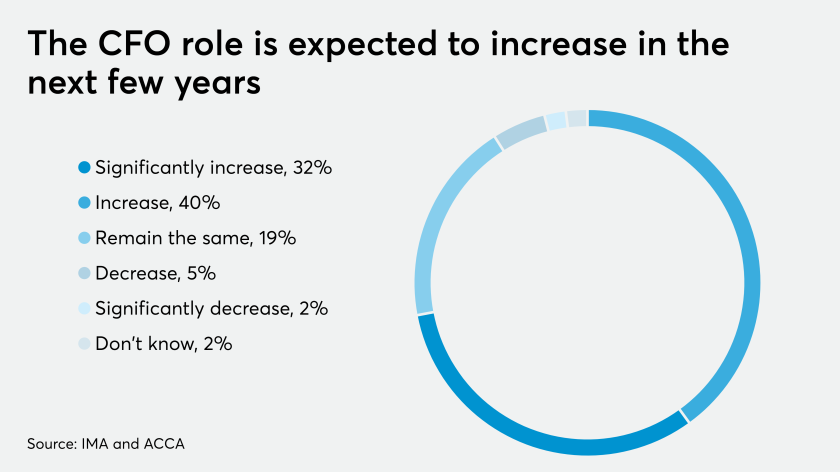

Finance executives are likely to hold onto their greater responsibilities once the pandemic subsides.

This dilemma has been plaguing the U.S. payments industry since the first credit card payments, made through a system as we know it today, began through the BankAmericard in 1966. Beforethat, a few banks, department stores and oil companies had experimented with their own issued cards.

After all, merchant acceptance of cards was a bit of an uphill battle. But as the market for credit cards grew, so did the interchange fee system and its many tentacles. By the 1980s, interchange was part of card network strategy to develop new markets for credit cards, as battle lines between brands became clearer and the dawn of debit in the 1990s was not far off. Big U.S. issuers flocked to Visa when it introduced signature debit transactions, a product priced below credit.

The pros and cons of interchange

While its roots are deep, the bitterness over interchange fees came to a head at the end of 2019 when a years-long antitrust case came to a proposed settlement of about $6.2 billion — which many merchants accepted, and the New York U.S. district court approved. However, a second phase of that case began as the merchants continued to seek injunctive relief and fundamental changes to future card brand rules and fee creation.

Those who support the need for interchange fees on credit and debit card payments say it is an economic necessity for a global card network that provides many benefits to its stakeholders. That network is the engine behind trillions of dollars in business.

However, those against interchange view it as a form of price fixing that unfairly constrains merchants' ability to directly negotiate prices for card acceptance, which has become a key service for nearly all retailers.

A middle ground holds that the mechanism is effective, but needs some form of governmental control to ensure that interchange rates remain reasonable. This group notes that network competition for issuance leads to rising, rather than falling, prices. This occurs because the network's customer (the issuing bank, which decides which network to use) receives the price that the network sets. In a "normal" market, a customer pays the price their provider sets.

One compromise some sought, and one the card networks loosened their rules to allow, was to give merchants the option to add surcharges to card transactions to help cover the costs of interchange. The swipe fee settlement allowed for surcharging, but a few states still ban the practice. Until those bans are revoked, many merchants will not see surcharging as a viable option.

To offset their costs, acquirers — the companies that establish merchant accounts on behalf of banks and provide needed point-of-sale hardware and software — established "interchange plus," the method by which they bundled interchange and other fees for merchants to pay. Over time, various other pricing models came into play as interchange got more complex, such as tiered pricing levels and a blended rate, which combined transaction types and volume to deliver a rate average.

Origins of interchange

In determining the best way to establish what they were initially calling an "issuer reimbursement fee" through third-party examinations of issuers' costs, the card networks focused on three key categories that eventually would become the basis for interchange.

They determined the value of card acceptance services to include the cost of a guarantee — basically the card issuer extending a payment guarantee to the merchant — even if the cardholder failed to pay what is owed. That has since been altered by a liability shift tied to EMV chip card acceptance to counter some levels of fraud.

The networks also cited the cost of funds, which basically means the merchant receives the payment from the issuing bank before the cardholder pays the bank. They also included operating expenses, figuring the issuing bank had costs for operating its authorization network, producing statements, handling service and other tasks.

Advancement and adjustments of interchange rates started flowing more readily in the 1980s, with special rates for point-of-sale terminals that could capture digital sales drafts, rather than paper, and also for different merchant categories — most importantly lower rates for grocery stores so they could start accepting cards.

Certain types of cards started getting different interchange rates attached, such as cards for businesses or with premium rewards, PIN or signature authorization. More recently, the rise of more card-not-present transactions through e-commerce or mobile devices has built more considerations for interchange pricing.

If an interchange rate sat at 2.20% for a premium card, the acquiring markup might be another 30 cents, leading to the creation of the "merchant discount fee" that would settle in at 2.50%. The same scenario for a standard credit card might equate to a 2.05% merchant discount fee, while a transaction with PIN debit could be around .80%

Complexity — a necessary evil?

To say interchange fees got complex for merchants would be an understatement.

That complexity led to the mistrust and uncertainty in the merchant community and, in the eyes of many, gave the card networks and acquirers an easy way to avoid the questions of how their fees are set and what their monthly merchant statements really mean.

One would be hard-pressed to find a merchant or group of merchants that would come out and say that accepting card payments is not critical to their businesses. Merchants have tried to replace the card networks, such as through development of the CurrentC mobile wallet several years ago, but those efforts never made a dent in credit cards' dominance.

The failed CurrentC wallet, which routed payments over the less expensive ACH network, illustrated the difficulty merchants would encounter in making decisions as a whole in an American open market. The venture was championed by giants such as Walmart, Target and Best Buy, but it failed to create a consumer following, and thus never got past the testing phase before it folded in June of 2016.

Without a merchant-backed alternative, retailers must juggle numerous pricing options available through hundreds of payment processors in the categories of flat rates, tiered pricing and interchange-plus pricing. Not all merchants know that, when starting out, flat-rate pricing makes for an easy way to accept card payments. But once the business grows, as most merchants would want, the other options could possibly save money over a longer haul.

Plus, Visa and Mastercard change rates twice a year, typically in April and October. That means that the largest fee a merchant pays, estimated at 70% to 90% of the total fees paid to banks, is a moving target. If that isn't complex enough, card-issuing banks, payment processors, the networks, payment gateways, and the merchant's own bank will charge a percentage-based fee on every transaction. The amounts are often bundled on the merchant's bill from its payment processor.

If that isn't complicated enough, recent research from BigCommerce noted that more than 300 individual interchange fees make up a "single" interchange fee that the merchant actually pays. Some of the card networks have tried to lessen that confusion by cutting back on specific categories within their rate structures.

Ultimately, interchange fees are determined by all of those variables. Plus a percentage of the sales total. And taxes.

Credit vs. debit

Various aspects of a transaction will affect interchange — the most significant being the card type. Debit cards used with a PIN have lower costs than credit cards because the addition of PIN security lowers the transaction's risk, as does the guarantee of funds from the bank account linked to the debit card.

PIN security was the main emphasis for some merchant groups during the launch of EMV chip cards in the U.S. During that migration, federal lawmakers unveiled the Durbin amendment to cap debit card fees coming from larger banks.

For the most part, card brands left the security decision about PIN up to the merchant, but Visa saw it as an unnecessary cost for merchants and felt the chip card alone would deliver what it was intended to do — thwart counterfeit card fraud.

The Durbin amendment may have capped merchants' costs, but it introduced other issues. The measure required cards to support two routing options, allowing merchants to route some payments through less expensive independent debit networks. Merchants worried that the specific implementations of this option could undermine its intent by nudging consumers to the more expensive network.

Plus, retail giant Walmart began digging in its heels again regarding fees, opting to stop accepting Visa cards at its stores in Canada and also making debit routing and its costs an issue with the major network.

The incident was a reminder of the long history of legal battles that Walmart, Walgreens and other merchants had fought against the card networks, suing for interchange recovery in 1998 and being awarded $3 billion in 2003. The lawsuits targeted signature debit costs, but also had the Honor All Cards rule altered to apply only within credit or debit cards, but not both together. The card networks established Honor All Cards as a way to assure merchants would accept all cards from their issuers, meaning if a merchant accepted Visa or Mastercard, it had to accept Visa cards from all of its issuers. Merchants felt this put them in a corner, in having to accept the potentially higher interchange rates from the premium or special cards from those brands.

Because rewards cards pay for perks given to cardholders, they too have carried higher interchange rates. The trade-off is that rewards cards encourage more purchases.

Business size and industry also affect interchange rates, with large merchants sometimes enjoying lower rates because of their ability to negotiate with the banks.

Point-of-sale transactions are viewed as far less risky than card-not-present categories such as mail order, telephone orders and e-commerce. Thus, card-not-present transactions carry higher fees.

Merchants understand the role that risk plays in their costs, but have argued that they should have a say in how those fees are calculated.

What the merchants want

The merchants' lawsuits have been based most often on the assumption that the card networks have violated antitrust laws. Merchants claim that if issuers would have to negotiate independently for card acceptance or if the merchants could decide which individual products it could accept, their costs would be lower.

“Interchange should be set in a transparent and competitive market and not one in which rules are created that lessen the ability for the market to set price," said John Drechny, CEO of the Merchant Advisory Group, an organization that helps merchants better understand how card network rules, political and legal machinations, and advancing technology affect their businesses.

"Merchants would advocate those rules be abolished, allowing for competition between the different products to exist instead of an all-or-nothing approach,” Drechny added.

While merchants accept the original purpose of interchange to help cover the cost to process a transaction, they claim that model was established at a time when carbon copies were collected and deposited with checks to be processed by the banks. Much has changed since those days, and the modern efficiencies should be reflected in lower interchange costs.

Overall, merchants find it difficult to accept the initial argument that interchange is established on the value it delivers to the different players in the ecosystem. By and large, they tend to view card acceptance currently as something far more ubiquitous with no real advancement of value. Through that lens, they liken it to be no different than needing electricity or running water at their business.

The central problem

Because interchange is what an issuing bank charges the merchant on debit and credit, it has always been a bone of contention with merchants and their lawyers that the issuing banks actually don't set their pricing. The card networks do that through what they charge the acquiring banks.

"That makes them this giant collective that involves the banks that issue cards under the Visa and Mastercard label," said Doug Kantor, a partner at Steptoe & Johnson LLP and legal counsel for merchants and the Merchants Payments Coalition, a group of retailers from various verticals that educate members about swipe fees, while also monitoring legal and network processes that affect the fees.

Merchants also view all of the other card network rules, including Honor All Cards, as factors that get in the way of a competitive market. When the card networks say they set interchange on the value of the transaction and the service, they must also balance the other side of the market — giving banks an incentive to issue their cards.

"What they are really doing is creating a cartel, with pricing that Visa and Mastercard has set with all of the banks, and what they actually do is ask how much they can get away with in charging fees," Kantor said.

In what merchants and their lawyers also view as a marketplace oddity, they note the highest fees are charged in industries that have the highest use and penetration of card payments; while the ones with lower fees, like grocery stores, were those that adopted card acceptance later.

"The truth is, Visa and Mastercard don't have to compete for merchants at all," Kantor said. "Because of Honor All Cards, they don't have to worry about merchant competition, so the merchants are stuck. It means the networks just compete for issuing banks in trying to get them to issue their cards."

Visa declined to comment for this story. It is not common for the card brands to participate in public debate about interchange through media outlets.

However, Mastercard provided a prepared statement: "Electronic payments play a vital role in powering everyday commerce, enabling people to buy the things they want and need in the safest, most secure manner possible, while delivering merchants increased efficiencies and guaranteed payments. Interchange helps keep the balance of value in the system for both merchants and the banks that issue cards."

In part, the general silence on behalf of the card brands has fueled suspicion and even the thought in some merchant circles that the card brands really can't provide a concise explanation for their rates. However, the card brands' general stance on interchange has been well documented and observed by industry experts.

"The original design for this whole credit card thing started as a model for check clearances," said Brian Riley, director of card services for Mercator Advisory Group. "But it became a privatized area in which the card networks have put billions and billions of dollars into the networks over the years, and should be able to recover some of those expenses."

It's hard for a card network to act as if it is a government entity or a nonprofit operation, Riley added. "It's a private business, there's no question about that, and no one ever said it was supposed to be nonprofit."

Ultimately, that's the difference between the U.S. card brands and domestic clearance schemes like Interac in Canada and Faster Payments in the U.K., where the service is meant to operate like a non-profit, low-budget business, Riley said.

"Interchange is only a part of what merchants pay," Riley said. "It is surprising that the other fees don't come up more often in conversations. It really is more of an acquirer issue."

Can technology lead to change?

There is a sense that the interchange model could undergo a digital transformation.

Or it could resist change. The outcome really depends on what merchants and consumers embrace in the coming years, especially with a crisis like the coronavirus pandemic pushing all parties to deploy or at least contemplate mobile and digital payment methods.

It appears the card networks themselves are pushing for a major shift into bank account-based transacting like Visa Direct, or Visa's purchases of Earthport and Plaid — or the various Mastercard equivalents of these products and relationships, said Steve Mott, principal of BetterBuyDesign, a Stamford, Conn.-based consulting firm.

With many faster payments networks coming online via entities such as Zelle and the The Clearing House, merchants have options for speedy payments that don't rely on credit card rails. These new options could create the pricing pressure that merchants have long desired, Mott added.

"Ultimately, in a digital environment that is not artificially constrained by legacy payment providers, debit card interchange would be more likely to begin to drop — maybe to something like 10 cents or lower," Mott said. "But without market or regulatory intervention, credit card rates would appear to be impregnable."

Overall, the ability to set interchange is enabled by the Honor All Cards Rule, as well as the companion rules to keep issuers from competing too aggressively, Mott said.

"Without some opening up to competitive market forces, this status quo looks to be sustainable over time," Mott said.

However, new technologies are proving that data can be exchanged at little cost, and that equates to less expensive processing power for computers to move payments along network rails. That all could eventually lead to a weakening of the card networks' interchange model.

"All of the technologies are there to completely disintermediate Visa and Mastercard," Steptoe's Kantor said. "With the little devices we have in our pockets we can move money around without the card networks or even the banks."

To the extent that some of those new technologies take off, some real market forces could begin to change the networks' views on what they could reasonably charge issuing banks, Kantor added.

The other side of that coin is that the major card brands are not sitting on the sidelines. They are building and acquiring new platforms that would keep them in the forefront of payments technology. The card brands aren't alone, as the processing industry saw much of this on full display with the multibillion-dollar M&A deals of the past year — Fiserv acquiring First Data; FIS buying Worldpay; and Global Payments purchasing TSYS.

According to Kantor, those companies are not going to suddenly put pressure on the card networks to lower interchange or, in turn, lower their own fees.

"The card networks would only reduce it if they had to … or really only don't increase if they had to," Kantor said. "They never really decrease it."