Mastercard reported a sharp decline in payments in its most recent quarter, but some digital seeds it planted before the coronavirus pandemic are already bearing fruit.

About 10,000 merchants in the U.S. have signed up for click to pay, an outgrowth of Secure Remote Commerce, the universal buy button the card networks jointly launched in 2019. The technology was developed as a way to streamline card payments at merchants without requiring shoppers to create an account everywhere they shop.

Mastercard is preparing the service for global expansion. As the click to pay grows, Mastercard is adding an additional layer of security through NuData, a security company it acquired in 2017.

As the pandemic accelerated a move to e-commerce — greatly benefiting digital companies like PayPal while slamming companies that emphasized in-person shopping and travel — usage of SRC has accelerated along with a boost in contactless payments as consumers and merchants move away from cash.

“Coronavirus has driven behavioral changes that will outlast the pandemic,” Michael Miebach, Mastercard’s president, said Thursday during the card brand’s earnings call. Miebach will become Mastercard's next CEO at the end of the year.

For the quarter that ended June 30, Mastercard reported earnings per share of $1.36 on revenue of $3.3 billion, down 28% from the same period last year but well ahead of analysts’ expectations. Wall Street’s expectations were a 39% dip to $1.15 per share with revenue falling 22% to $3.23 billion, according to Zacks Investment Research.

Transactions fell 10%, purchase volumes were down 9% and cross-border volumes fell 45%. Operating expenses fell 5% to $1.628 billion. Mastercard did not provide an outlook, citing the pandemic.

While overall payments were down, contactless payments grew to 37% of all transactions, up from 20% in the prior year, and Mastercard reported 70% of consumers plan to increase or continue using online channels for payments, citing internal research. During the earnings call, Mastercard repeatedly stressed these trends are permanent, providing opportunity for it to use its APIs, fintech partnerships, services and tokenization to mine new sources of service and payment revenue.

Mastercard’s platform allows it to support the shift to digital, business and contactless payments, said its current CEO, Ajay Banga.

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

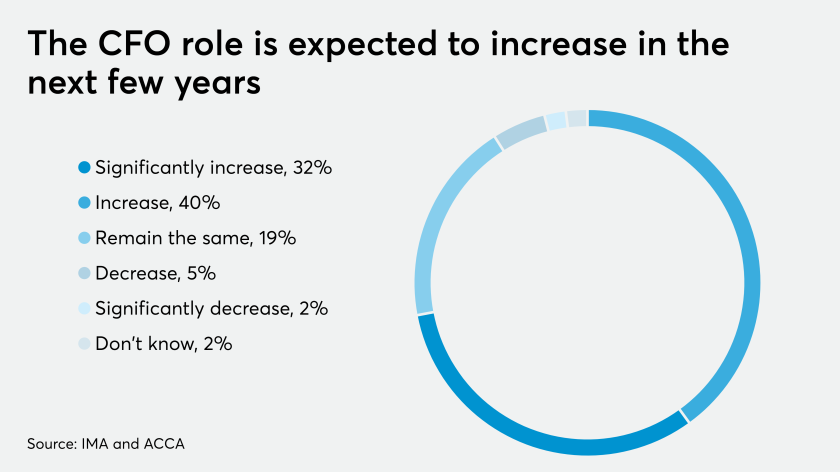

Finance executives are likely to hold onto their greater responsibilities once the pandemic subsides.

The card brand has recently started or expanded partnerships with Samsung, Apple, the Asian ride-sharing company Grab and others, as part of its “digital first” initiative.

“There are opportunities to accelerate the secular shift to digital forms of payments,” Miebach said.

Mastercard has launched a global “digital doors” initiative that includes payment gateways, cybersecurity and other services designed to boost financial inclusion and fund small businesses. Mastercard has additionally set aside $250 million to fund small businesses as part of a broader financial inclusion initiative.

Financial inclusion is also part of Mastercard’s diversity efforts. The card brand hopes to bring one billion people into the financial system by 2025, and has made support for micromerchants and new businesses in underserved communities part of that effort.

The card brand achieved pay equity between non-Caucasian and Caucasian staff in 2019, and the company has accelerated its internal diversity efforts, Banga said.

Companies across the U.S. and globally have examined racial, ethnic and gender inequality, mostly in the wake of the killing of George Floyd in police custody in Minneapolis. American Express and Visa also addressed the issue during their recent earnings calls. Banga has been outspoken in the past about social issues, critizing the Trump administration's 2017 travel ban on a set of countries with high Muslim populations.

“There’s no place for racism or discrimination in our communities, companies or our hearts,” Banga said.