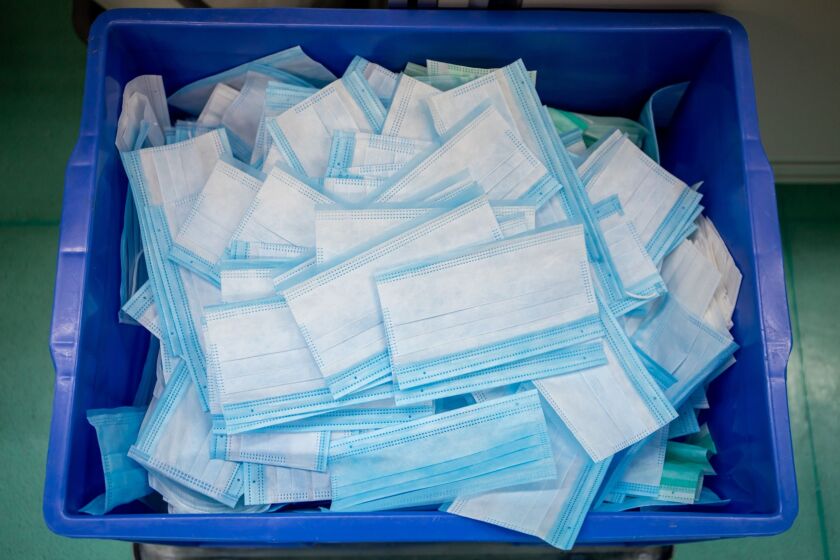

The shortage of personal protective equipment (PPE) for medical workers is one of the most troublesome elements of the coronavirus outbreak, though prior work to declutter cross-border supply chain payments provides some hope.

“Numerous supply chains have been disrupted. Medical supply chains for personal protective equipment in particular have been critically disrupted with manufacturing slowdowns in Asia Pacific further exacerbated by unprecedented global demand in the rest of the world,” said Thor Perplies, treasury sales officer with Citigroup’s Commercial Bank.

The Citi unit used Flywire’s payment network to move about $1 million to a supplier in China to procure 1.4 million pieces of PPE for hospitals in the Boston area through The Boston Foundation, a community nonprofit that worked through a connection students from Harvard Business School had to a medical supplier in China. It’s an example of how faster payments and open banking, or the streamlined collaboration between fintechs and traditional financial institutions — something large banks for years considered a threat — can mitigate the impact of a health crisis.

Buying medical masks and gowns from an international source should be a relatively simple transaction, but the coronavirus has created disarray. The shortages of PPE, items such as gowns, masks and gloves have left medical workers dangerously exposed to coronavirus as cases spike. It’s an international problem that’s led to ill-timed competition and regulatory hurdles.

PPE and lots of other medical equipment comes from China and other parts of Asia, presenting a host of problems ranging from heavy regulation to political fallout from the virus and the previous trade war.

The Internal Revenue Service will allow businesses that got their Paycheck Protection Program loans forgiven to write off expenses paid for with that money, shifting policy after Congress passed new legislation last month.

The Internal Revenue Service and the Treasury Department released guidance on claiming deductions for expenses associated with Paycheck Protection Program loans that have been forgiven.

The Internal Revenue Service is once again depositing the latest round of Economic Impact Payments in the wrong bank accounts in a replay of problems experienced last year by many taxpayers.

A delay in payments causes an added disadvantage, leaving the traditional model of using correspondent banks to manage currency exchanges not only obsolete, but dangerous.

“Normally a transaction of this nature would take a day or two longer to process because the beneficiary bank needs to open a service case and triangulate data between the beneficiary, Citi, and Flywire,” said Perplies, adding that with coveted PPE procurement, there was an extreme sense of urgency.

Flywire, a Boston-based fintech that uses a global network of banks to avoid third parties for supply chain payments, alerted the PPE supplier that a payment from Citi needed to be reviewed by the suppliers’ banks before the funds could be applied to their account. The regulations mandated a contract, invoice or customs slip.

“It was important that the beneficiary bank quickly locate the payment, reconcile the transaction with the supplementary documents and then apply funds,” Perplies said.

For years, these types of transactions required third parties to hold funds in the different markets. New alternatives have emerged that use cloud structures or blockchains to eliminate third parties. Ripple is well known in this market, using the technology that supports the XRP token to facilitate international payments.

Banks initially viewed Ripple as a competitor, though increasingly banks are partnering with Ripple. Flywire works through a network of local partners to offer local currency payments for two sides of a transaction, such as a student from Asia attending university in the U.S. It also manages local compliance and security risk management.

“We have teams on the ground who are able to perform tasks such as ‘know your customer’ checks,” said Ryan Frere, executive vice president of payments at Flywire.

Flywire held accounts with Citi in Asia and the U.S., enabling the cross-border payment within Citi’s network. “By holding bank accounts in many markets with Citi, Flywire was able to quickly secure transaction approvals,” Perplies said.

Citi recently launched a collaboration between its Treasury and Trade and Foreign Exchange units to link local payment processing, FX and account management. Flywire has partnered with other banks, including a deal late in 2019 with Bank of America to boost cross-border tuition and corporate payments.

PSD2, a European regulation, has sparked global moves toward enabling open banking, or using APIs or similar methods to share information between banks and technology companies. While large banks initially pushed back against this trend, the benefits have become more apparent in time as banks find ways to broaden services to clients while embracing new payment innovation quickly.

Writing for PaymentSource, Paul Wilmore, chief marketing officer for U.S. consumer business at Barclays, said fintech collaborations can strengthen banks.

During the coronavirus pandemic, open banking has emerged as a way for consumers to link digital services to banks with minimal contact, forging a migration to digital financial services that will likely be permanent.

“It highlights the fact that fintechs aren’t really disruptors for banks,” Frere said.