Inaccurate payments have plagued accounts payable and receivable departments from the time suppliers' contracts and invoices were stored in boxes and file drawers to the dawn of data-driven digital transactions.

The more data and transactions that flow through a business, the more likely that duplicate payments, wrong amounts, wrong addresses, wrong pricing or any other number of costly mistakes will come into play.

Throw in the coronavirus pandemic, which has caused many AP/AR employees to abruptly work from their homes, and the potential for payment errors rises significantly.

Given all those factors, an AP recovery audit for a large business dealing with numerous suppliers is more vital than ever, said Angie Holsen, senior director of commercial client relationships at Atlanta-based PRGX Global.

PRGX estimates it recovers more than $1.2 billion in overpayments annually for its clients through the recovery audit that reviews AP transactional data to identify overpayments, duplicate payments, missed or miscalculated deductions and recovering them from suppliers.

"Companies have controls in place to catch errors, but everyone is human and no one is perfect, and errors happen," Holsen said. "So this is one more control on the back end for people to perform and identify things."

In its work, PRGX technology catches invoicing number flaws and oversights or malfunctions in enterprise resource planning systems, while also revealing uncertain payment parameters and rejected credits from returned goods. The company pushes the need for increasing accounts receivable reviews.

For advisers and their clients, the crisis has ushered in a new era for mental health, caregiving and telemedicine platforms

PricewaterhouseCoopers has developed a contact-tracing app as the Big Four firm looks forward to reopening its offices during the coronavirus pandemic and tries to help its clients safely open theirs as more states announce plans to gradually lift their stay-at-home orders.

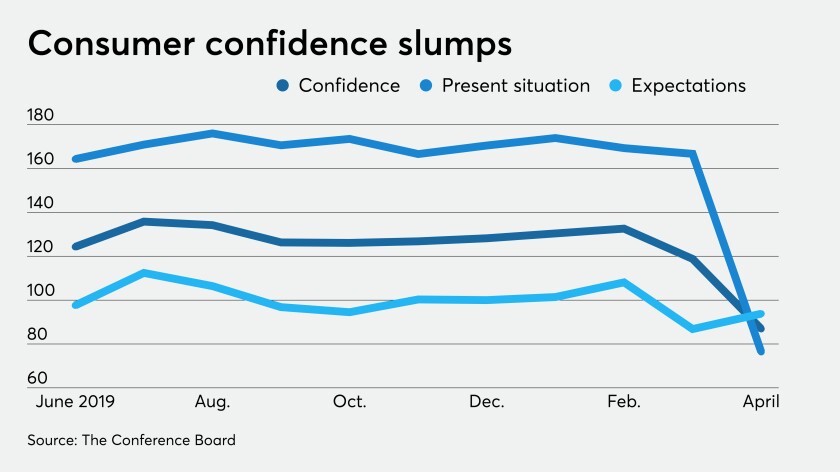

Pessimism about the economic situation in the United States continues to affect the way consumers view the economy and their financial position.

"In the business world, even with the best controls in place, a new person can be put on the job who has maybe not been trained fully yet, or is entering data into a new system," Holsen added. "Maybe that person didn't spot some possible risks for error, or maybe there was a recent merger and as they were pulling data they meant to identify it as something else."

It's important to note in the world of AP recovery audits that even if a large company is 99% accurate with $20 billion in annual spend, a small error could result in $1 million to $2 million in lost spend, Holsen said.

"Sometimes those inputting invoices will think their system will catch errors, but maybe it won't," Holsen said. "Uploads that avoid an ERP entry process that can help avoid duplicate payment checks will sometimes happen."

Each AP department process has so many moving parts. It's almost as if the actual payment isn't the most important task that occurs.

"A purchase can be of 50 items, but the bill of lading may be 40 things because not everything is delivered at the same time," said Peter Michaud, director of consulting at Strawhecker Group. "An invoice could also be generated by a contract with different pricing; and in larger companies, pricing is incredibly sophisticated."

Even though companies operate under the logical practice of paying only for what was ordered, the amount of data moving back and forth as companies grow larger can result in payment mistakes and reconciliation nightmares.

"It happens, but it shouldn't if every invoice is its own original," Michaud said. "But problems can arise when someone is paying off of a statement, and not the invoice."

If a company employee doesn't know which suppliers tend to send statements first, then invoices later, they might be inclined to not catch the difference, Michaud added.

"It's a process-driven department that can be doing 10,000 invoices, with 100 of them having some issues," Michaud said. "That is only 1%, but chances are it could be 5% if there is wrong pricing, or you paid for something that did not get shipped."

Various companies have tried to tackle this problem over years, among them Bottomline Technology's PayModeX platform and its digital conversion services; Comdata's emphasis on virtual cards payments; and AvidXchange with its focus on helping middle market companies go digital under work-at-home mandates — all seeking to manage AP automation and make payments through cloud-based services on behalf of a client company.

AP payment errors may never be fully resolved, and businesses that help monitor payments and recover money will always have a key role because B2B payments are not likely to undergo the type of dramatic change it would take to remedy flaws, Michaud said.

"Until you can tell me that a payment from my company to another company had to go through the same central location with standardized formats and common pricing, the mistakes part will never be solved," he said.