U.K. fintechs are using their technology to assist British businesses and consumers during the coronavirus pandemic by helping banks disburse emergency business loans, enabling e-commerce merchants to offer installment payments to consumers, and giving employees access to salary advances.

Lending fintechs have been expanding their business lending for some years. According to the Bank of England, since 2017, the majority of U.K. net growth in SME financing has come from smaller banks and fintech lending platforms.

Now, with the U.K. government rushing to disburse aid to smaller businesses, lendtechs have seen new demand for their services. The government’s Coronavirus Business Interruption Loan Scheme (CBILS) is available through banks and B2B loan providers to businesses with revenues of up to £45 million, while the Bounce Back Loans Scheme (BBLS), which has a 100% government-backed guarantee, targets small and micro-businesses with loans of up to £50,000. BBLS and CBILS lenders are accredited and funded by the British Business Bank, the government’s economic development bank.

“With many banks getting the equivalent of 15 years’ worth of loan applications from cash-strapped businesses in one or two weeks, no-one had the resources to be able to cope, and they are having to completely overhaul their current processes,” said Yasamin Karimi, head of product at U.K.-based business data integrator Codat.

Joanne Dewar, CEO at U.K.-based fintech Global Processing Services, said that, because fintechs are unencumbered by legacy systems and have a cloud-native approach, they are better able to navigate the COVID-19 landscape than incumbent banks with their legacy technology.

To automate and speed up loan disbursement, some banks are turning to fintechs. Codat developed a white-labeled application for an unnamed Tier 1 U.K. bank, which used the technology to get its CBILS loan process live within a week. Two other major U.K. banks also use Codat’s technology for loan disbursement, although not for CBILS loans.

President-elect Joe Biden will seek a deal with Republicans on another round of COVID-19 relief, rather than attempting to ram a package through without their support, according to two people familiar with the matter.

The work-from-home phenomenon has triggered a fresh frustration for U.S. corporations: Americans are blowing the whistle on their employers like never before.

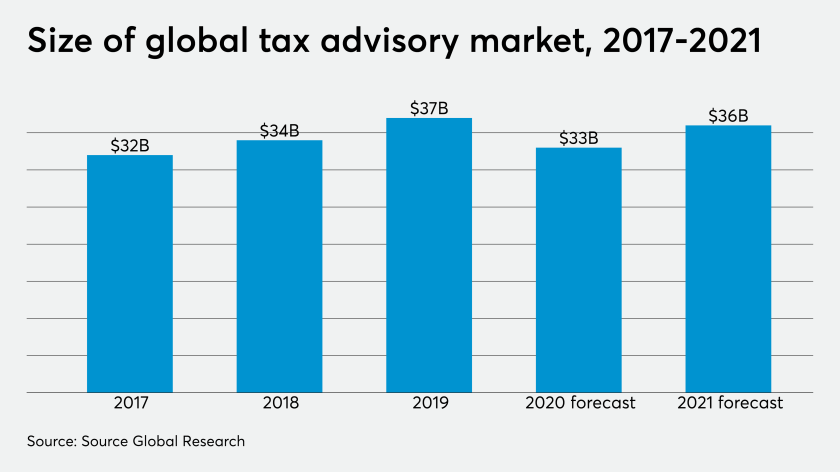

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

Codat now offers its white-labeled CBILS application to its other U.K. clients such as MarketFinance, which are accredited CBILS lenders, and has developed a BBLS application.

Acting as an aggregator, Codat gives business lenders one entry point to multiple accounting packages, so they can access their small business customers’ profit-and-loss statements, invoices and balance sheet data without manually uploading this information.

“Codat allows small businesses to share their financial data automatically and pre-fill the Tier 1 bank’s CBILS loan application form,” said Karimi. “Over 100,000 businesses have used Codat’s application form to ask for CBILS and BBLS loan funding as part of the flow we built.”

Another use for Codat is in automating access to receivables financing. U.K.-based Dancerace has created the F3 portal, where businesses can apply for government COVID-19 loans and working capital from lenders’ linked websites.

“Receivables finance has an important part to play in helping businesses get back on their feet following COVID-19,” said Elliot Avison, Dancerace’s CEO. “So we created F3 as a customer onboarding application to speed up and simplify theto its other U.K. clients such as MarketFinance, which are accredited CBILS lenders, and has developed a BBLS application. credit application process for SMEs. Data extraction, as provided by Codat, is an integral piece of the puzzle, as it eliminates the effort of gathering accounting paperwork during the application process.”

The U.K.'s digital-only Starling Bank has been leveraging its digital expertise to offer CBILS and BBLS loans and sign up new business customers in the process. It has partnered with small-business loan platform Funding Circle to provide businesses with £300 million of CBILS loans.

Funding Circle is able to offer businesses a decision in as little as four minutes through its instant decision technology, U.K. managing director, Lisa Jacobs, said in a news release.

Separately, Starling also provides BBLS loans. In the first week after it launched its BBLS loans on May 11, Starling approved £269 million in loans to SMEs.

Prior to offering CBILS and BBLS loans, Starling had around 150,000 small business banking clients.

“We opened over 9,000 business and sole trader accounts in the first week after going live with BBLS, compared with around 7,500 the week before,” said Alexandra Frean, Starling’s head of corporate affairs.

“We were able to offer BBLS and CBILS loans so quickly, as we're a small organisation and work in an agile manner,” Frean said. “This means we're not held back by organizational silos, bureaucracy or hierarchies. There's a ‘can do’ culture and our employees care about our mission. They are willing to work round the clock for customers when needed.”

Point-of-sale financing and installment payments are another service currently in demand by U.K. businesses.

"Several months back, consumers would come into our Leicester showroom and spend whatever amount of money was needed to buy appliances they wanted,” said Rob De Rienzo, sales director at DR Appliances. “Now things are different. There’s a bigger shift towards our online store, and more of our customers are being cautious about what they spend. This is a worry for us as a small business, since every sale really does matter.”

U.K.-based DivideBuy provides point-of-sale financing to e-commerce retailers enabling customers to make interest-free installment payments for their purchases. It has started offering this service to smaller merchants such as DR Appliances with annual revenue of over £100,000 to encourage customers to spend at these businesses. Originally, DivideBuy offered point-of-sale financing only to larger merchants.

“We hope that smaller retailers will benefit from offering their customers the chance to split payments, and that large-value items will remain accessible to consumers, enabling them to buy what they need when they need it, with the option to pay later,” said Robert Flowers, CEO of DivideBuy.

To support smaller retailers, DivideBuy is offering them an initial payment holiday on its subscription fee and reduced rates for the first three months.

“We’re thankful for DivideBuy’s installment payment service,” De Rienzo said. “As a small business selling white goods, we would usually be put in the ‘risk’ category by the bigger lendtechs, but DivideBuy is supporting us and helping us secure much needed sales during these turbulent times.”

Automated salary advances are also in demand, particularly when employers are concerned about their staff’s financial wellbeing.

Hastee, a U.K.-based earnings-on-demand platform, gives employees access through an app to a portion of their salary, at any point in the month, with employers reimbursing Hastee on their standard payday. This provides an alternative to getting into debt through credit cards, overdrafts or payday loans. Employees pay 2.5% per transaction, but the service is free to employers.

As many British people are currently under financial pressure, Hastee has waived all transaction fees for the next three months for its 100,000 users. Hastee has further waived all fees for six months for National Health Service workers.

“We’ve had a positive response to the waiving of our fees, particularly from NHS staff,” said Hastee’s CEO James Herbert. “We never charged extortionate fees, but now we wanted to go the extra mile to ensure that those facing tough times during the outbreak can access the funds they’ve earned when they need them.”

London City Airport (LCY) has implemented Hastee’s solution, enabling staff to receive up to 50% of their gross pay for the work they have completed. As part of its platform, Hastee provides LCY staff with a financial education program.

“Hastee has empowered our staff to manage their personal finances more effectively,” said Stephanie Powell, reward manager at LCY. “Instead of getting into debt, our staff can withdraw a portion of earned pay when they need extra cash. Tackling financial stress should be a big part of any workplace wellbeing strategy. Implementation was fast and hassle-free, and the solution cost us nothing.”

In December 2019, Hastee received £208 million in funding led by Umbra Capital Partners.

“The way we get paid hasn’t changed," said Charles Gallagher-Powell, a partner at Umbra Capital. “We still have to wait until month end for salaries to be deposited into bank accounts, but there’s no reason why we shouldn’t access our pay as we earn it. This premise is at the heart of why we invested in Hastee, which wants to revolutionize the way people get paid.”