The initial adoption wave that mobile and contactless payments have ridden during the first months of the coronavirus pandemic is likely to continue as companies adjust business models to make embedded payment methods a key part of their strategy.

Earlier this month, Uber Technologies agreed to acquire Postmates in a $2.65 billion all-stock deal to expand its food delivery services — and help offset the loss of ride-sharing revenue because people are sheltered at home. It represents significant transformation for the payments industry in that it further pushes consumer habits' toward digital, embedded payments.

"Uber buying Postmates is a big splash and it matters in the payments world because it is one more situation that will force people to use their digital wallets, and not cash, for food items," said Ryan Patel, senior fellow with the Drucker School of Management.

"It's another example of people getting more comfortable with digital payments," Patel said during a recent Worldpay/FIS webinar on global payments trends. "It foreshadows a lot of different things, in that knowing how you integrate payments technology for the end user is super important."

Uber may not have its plan for Postmates in place just yet, but "if Uber wants to be successful and more profitable, the payment has to be really smooth," Patel said. "You can't just throw it into Uber Eats and wish everyone is going to be able to do it. Many companies go ahead and enter a partnership, but don't make the ordering and payment any smoother for the end user."

When taking into account the economic hardships the pandemic has created for merchants and consumers, another payment trend — the concept of buy now, pay later — is likely to become increasingly popular in e-commerce and multi-channel scenarios.

As an indication of its growing popularity, more than 130,000 merchants worldwide offer Klarna instant financing. Klarna raised $460 million in funding last year to push the Swedish company's valuation to about $5.5 billion.

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

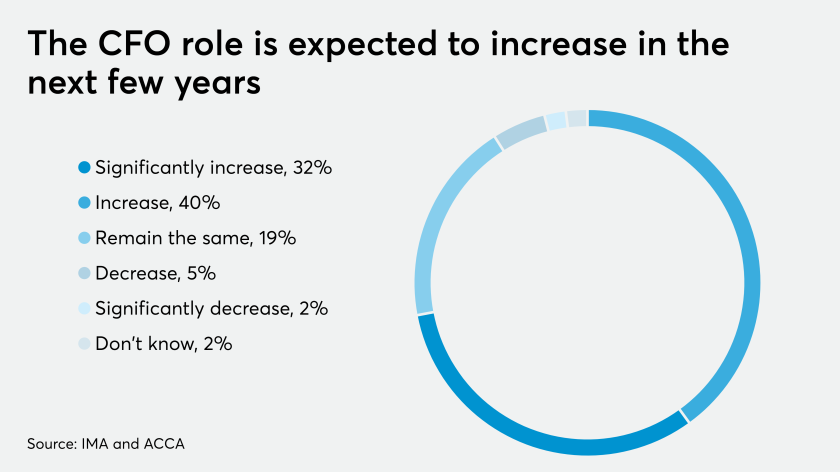

Finance executives are likely to hold onto their greater responsibilities once the pandemic subsides.

Ultimately, the buy now, pay later model is going to become a "have to have" service for merchants, said Kevin Hennessy, vice president of strategic solutions at Worldpay/FIS.

"When thinking about the different demographics over time, layaway payments have been extremely popular for more than 40 years, but the popularity waned some recently and credit card debt has gone up exponentially over time for a lot of people," Hennessy said.

It is likely that Generation Z consumers, who are more comfortable in sharing information, will view the buy now, pay later option as a tool for responsible spending, Hennessy said.

"This is not a debit instrument or a credit instrument," he added. "This is for when you don't want to put yourself in a position to have bad credit card debt, while pushing healthier spending."

As other companies like Affirm, Afterpay and Splitit bring different installment payment models to the point of sale or e-commerce checkout, merchants will have to determine what works best for them based on market demographics.

According to the latest Worldpay Global Payments Report, the buy now, pay later option has become 2.8% of the e-commerce market worldwide, growing quickly and forecast to be at $165 billion by 2023 in e-commerce alone.

Countries with the fastest growing use of buy now, pay later are those that had a percentage of transactions handled with that method in 2019, according to the report. Sweden was at the top at 25%, with Norway at 13%, while Argentina, Finland and the Netherlands each had 8% of its e-commerce transactions through that payment method. Belgium was at 6% and Denmark at 7%.

Others projected to grow in 2020 because of the pandemic include the U.K. at 3%, Japan and France at 2% of transactions as buy now, pay later; and the U.S. at only 1%.

Overall, the move toward digital payments in North America is likely to double over the next few years, putting the U.S. and Canada on tracks similar to what the Asia and Pacific regions have enjoyed. More than 70% of transactions in China currently come through a digital wallet, the report noted.

"Over the last six months, we have seen the trend change, as one in four transactions in the U.S. are now through a digital wallet, and one in five in Canada is digital," Hennesy said. "We will see this double in the next few years."

Even though the COVID-19 pandemic has been a devastating health crisis and a major blow to global economies, it is not time for merchants to feel that all is lost.

"Do not leave money on the table and don't be saying you can't do something because of technology," Patel said. "This is the time to try something. Things are changing and you can't expect it to go back to normal, and we don't know what it all means right now."

As much as anything, merchants and consumers alike can't be thinking that brick and mortar retail is dead. It is not, Hennessy said, but it is changing. "It's a digital acceleration and you just have to be smarter about the omnichannel experience," he added.

"Be smart about handling customer profiles and targeted ads, and allowing flexibility for returns in the store, and having considerations for buy now, pay later for Generation Z," Hennessy said.