MoneyGram International's digital transformation came at just the right time, considering walk-in traffic at MoneyGram locations in certain regions of the world was stymied for months by the coronavirus pandemic. But for many people, digital is still no replacement for the human touch.

Investments in digital technology over the past four years are paying off for MoneyGram now — to the tune of 106% digital transaction growth during the second quarter of 2020 compared to last year. Digital transactions accounted for 27% of all money transfer transactions in the second quarter, compared to 18% at the end of the first quarter.

Even as digital transactions grew, walk-in business was still vital to MoneyGram's performance, particularly as lockdown restrictions eased near the end of the quarter.

The pickup in digital and walk-in business helped MoneyGram deliver positive growth to offset the net loss of $4.6 million. Considering the early COVID-19 effects, and the drop in interest rates of which the company had no control over, MoneyGram "handled the crisis extremely well," MoneyGram CEO Alex Holmes said Friday during the Dallas-based money transfer provider's earnings call.

Holmes cited the company's years-long focus on creating a direct-to-consumer digital experience, a loyalty/rewards program and personal digital communications to the customer as keys for the successful transformation MoneyGram has made.

MoneyGram Online, the company's direct-to-consumer channel, showed 104% transaction growth compared to a year earlier, a mark fueled in part by strong demand for the MoneyGram app. In addition, Holmes said, MoneyGram is finding that it is retaining online customers more readily than walk-up customers.

Most importantly, Holmes noted, walk-up traffic was sporadic because of locations opening and closing, but the digital business didn't slow down.

President-elect Joe Biden will seek a deal with Republicans on another round of COVID-19 relief, rather than attempting to ram a package through without their support, according to two people familiar with the matter.

The work-from-home phenomenon has triggered a fresh frustration for U.S. corporations: Americans are blowing the whistle on their employers like never before.

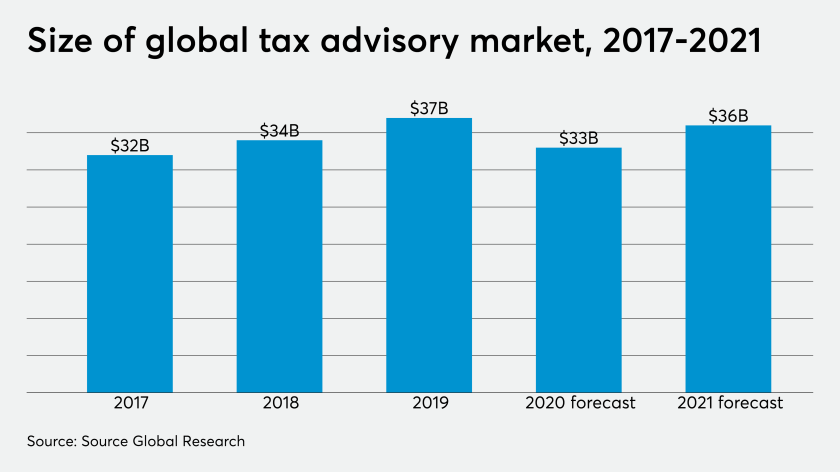

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

"Digital business accelerated and continues to push forward," Holmes said. "I think we are taking share from a lot of the other traditional players out there and competing extremely well with some of the pure-play digital guys (companies)."

Account deposit and mobile-wallet-receive transactions increased 148% during the quarter compared to last year, but it also represented an increase beyond the 80% growth the company reported in the first quarter.

Total revenue was $280 million, a decline of 13% on a constant currency basis, primarily driven by the impact of COVID-19 on the first part of the quarter and lower interest rates on investments. Money transfer revenue was $253 million, down 10% from last year.

Larry Angelilli, chief financial officer at MoneyGram, pointed to EBITDA (earnings before interest, taxes, depreciation and amortization) quarterly sequential growth at 10% as an indicator the company is on the right track and overcoming a slow start in the quarter. When shelter-in-place mandates began to ease, MoneyGram saw a spike in business, Angelilli said.

"When we shifted from a brand recognition strategy to a digital strategy, it also had an impact on the amount of money it takes to market," Angelilli said. "Some of those things are permanent, as we have a different marketing approach with a different expense base."

Angelilli said MoneyGram's "entire backbone is modern now, so we can change things on the fly that used to take months or maybe years, and that is a significant cost savings as well."

MoneyGram executives did not address the reports of last month that Western Union was prepared to make an offer to acquire MoneyGram. Executives from both companies have been mum on that potential development so far; Western Union delivers its quarterly earnings report on Tuesday.

At the same time the Western Union speculation surfaced, MoneyGram was reporting digital transaction growth of 100% in May compared to a year earlier.