The initial direct deposits of the second round of economic impact payments are already going out to taxpayers.

The American Institute of CPAs is firing back after a congressional hearing, asking for penalty relief for taxpayers dealing with the pandemic.

The pandemic is throwing a monkey wrench into plans for the Internal Revenue Service to reorganize itself to provide better taxpayer service.

The IRS is making some changes in its collection program to lessen the burden on taxpayers with outstanding tax debts who are trying to cope with the economic fallout of the COVID-19 pandemic.

The Internal Revenue Service said Friday it would restart issuing its 500 series of balance-due notices to taxpayers later this month after they were paused on May 9 due to the COVID-19 pandemic.

The leaders of Congress’s main tax-writing committee are wondering if the Internal Revenue Service will be ready to handle next tax season as it’s still processing millions of pieces of correspondence that went unopened for months during the COVID-19 pandemic.

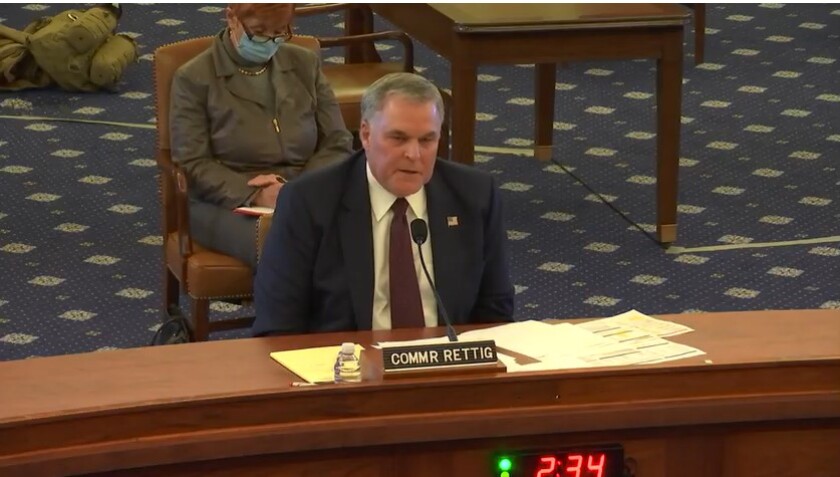

Internal Revenue Service commissioner Chuck Rettig heard complaints from lawmakers about their constituents missing stimulus payments.

The Internal Revenue Service plans to mail out letters later this month to an estimated 9 million non-filers, encouraging them to claim their economic impact payments by an Oct. 15 deadline.

House Ways and Means Chair Richard Neal wants the IRS to quit sending balance due notices for now.

The Internal Revenue Service is giving parents another chance to list their kids so they can receive an extra $500 per child in economic impact payments under the CARES Act.