This article looks at a few key components of the presidential nominees' tax positions.

Senator Kamala Harris condemned the Trump administration’s handling of the pandemic as the worst failure in U.S. government history, but evaded answers on the Democrats’ positions on the environment and the Supreme Court.

The Internal Revenue Service issued guidelines Wednesday scaling back a tax break for client entertainment, following through on an element of President Donald Trump’s 2017 tax overhaul that he has said he wants to reverse amid the virus pandemic.

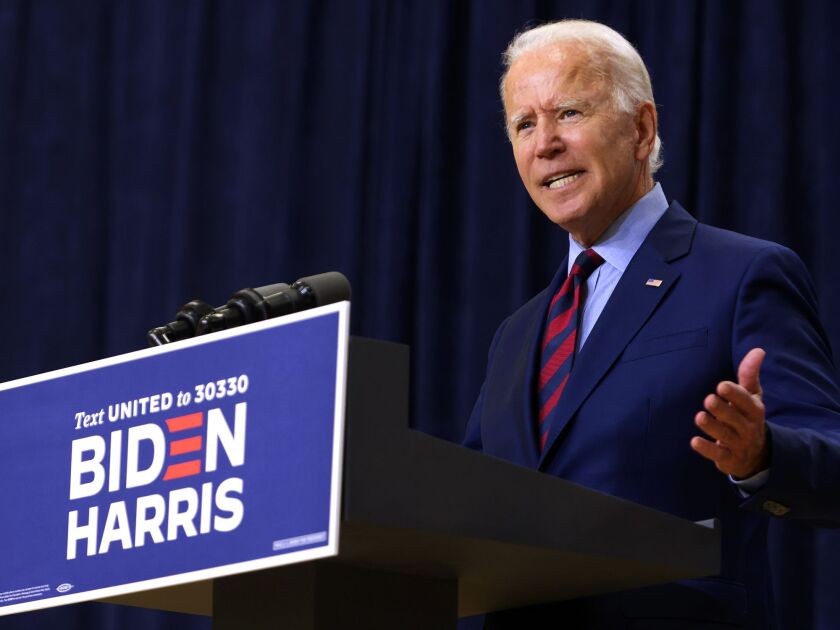

Democratic presidential nominee Joe Biden released his 2019 tax returns hours before the first debate with President Donald Trump, showing that he paid $299,346 in income taxes in 2019.

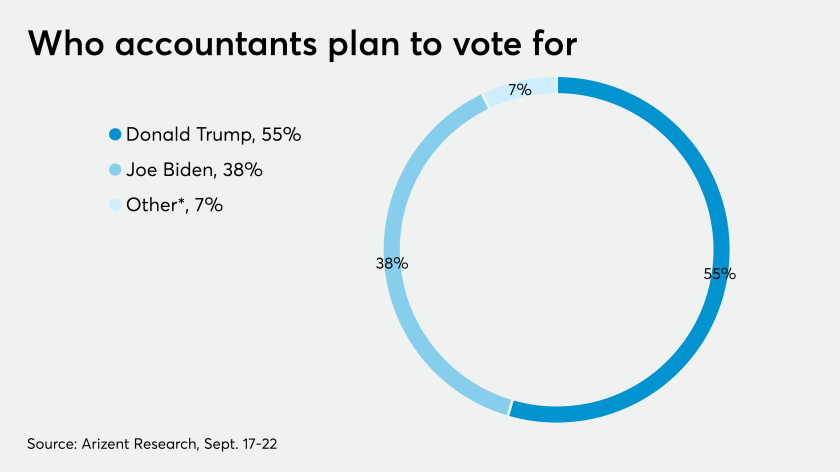

Regardless of their voting intentions, they overwhelmingly expect things to improve after Nov. 3.

A month after President Donald Trump moved to shore up workers’ incomes by giving employers the option of deferring payroll taxes, the effort has failed to energize a U.S. economy still reeling from the coronavirus pandemic.

The Internal Revenue Service issued some eagerly anticipated guidance on President Trump's executive order.

The U.S. Treasury Department still has yet to tell companies how to handle President Donald Trump’s order delaying the due date for employee payroll taxes, leaving major employers like Walmart Inc. in the lurch.

The Democratic presidential nominee Joe Biden expressed optimism and hope about overcoming the economic crisis and other challenges during his acceptance speech at the virtual Democratic National Convention.

The U.S. Chamber of Commerce and other organizations are sounding the alarm about the impact of President Trump’s order.