President Donald Trump spent months on the campaign trail taking credit for “opportunity zones,” a policy meant to encourage investment in distressed communities across the U.S. Joe Biden’s team sees potential in the idea, too.

The president-elect's pledge to repeal President Donald Trump‘s tax cuts as soon as he is inaugurated may be stymied for the foreseeable future.

The outcome of Tuesday’s election could be profound tax changes, but that’s only if one party wins control of both houses of Congress and the White House.

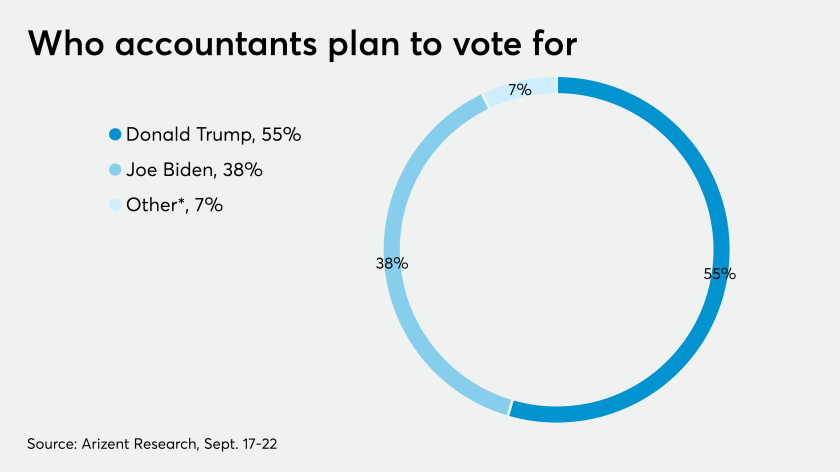

As the country looks to make its choice between two decidedly different candidates, tax preparers are watching the race play itself out from a unique vantage point.

Former vice president and Democratic presidential candidate Joe Biden’s tax proposal will limit direct tax increases to just 1.9 percent of taxpayers.

This article looks at a few key components of the presidential nominees' tax positions.

Senator Kamala Harris condemned the Trump administration’s handling of the pandemic as the worst failure in U.S. government history, but evaded answers on the Democrats’ positions on the environment and the Supreme Court.

Democratic presidential nominee Joe Biden released his 2019 tax returns hours before the first debate with President Donald Trump, showing that he paid $299,346 in income taxes in 2019.

During the 2020 presidential campaign, Democratic candidates made many proposals for changes to the Tax Code, ranging from changes to the tax rates to the imposition of a new 5 percent excise tax and a national sales tax.

Regardless of their voting intentions, they overwhelmingly expect things to improve after Nov. 3.