Too many advisors push clients “to do things, rather than listening and empathizing and inspiring them,” says the founder of the Kinder Institute for Life Planning.

Whether you’re in search of a roadmap, strategies — or peace of mind for your clients — these recommendations fit the bill.

We've had many chances to learn, from the dot-com bust to the 2008 financial crisis. But the storm is perhaps most applicable to our current situation.

As a longtime proponent of flat fees, I see a lot of pain ahead for firms that rely solely on assets under management.

Senior leaders at the No. 1 IBD meet daily about the pandemic as large enterprises set their own continuity plans into motion with an eye toward ensuring operations.

It’s another action taken by wealth management firms to safeguard employees and clients from the coronavirus.

Advisors may find it difficult to connect with the people who need financial help the most.

Many advisors are doing heavy lifting right now — or expect they will be — in the midst of growing coronavirus fears.

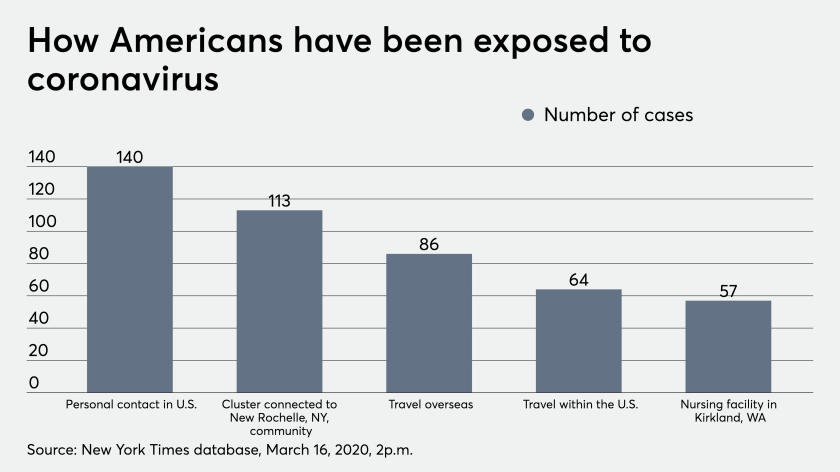

There are more than a hundred cases of COVID-19 in Westchester County, New York, and financial planners are handling more than market volatility.

Where some see unacceptable risk, others are eyeing bargain airplane tickets.