Outsourced accounting is among the options business leaders should carefully consider in these unprecedented times.

PricewaterhouseCoopers has been building its managed tax services business since 2017, but now it sees an opportunity to help companies who are dealing with COVID-19.

The provider of payroll, benefits and human resources for small businesses, is rolling out a program for accountants who want to be certified in providing the company’s services to their clients.

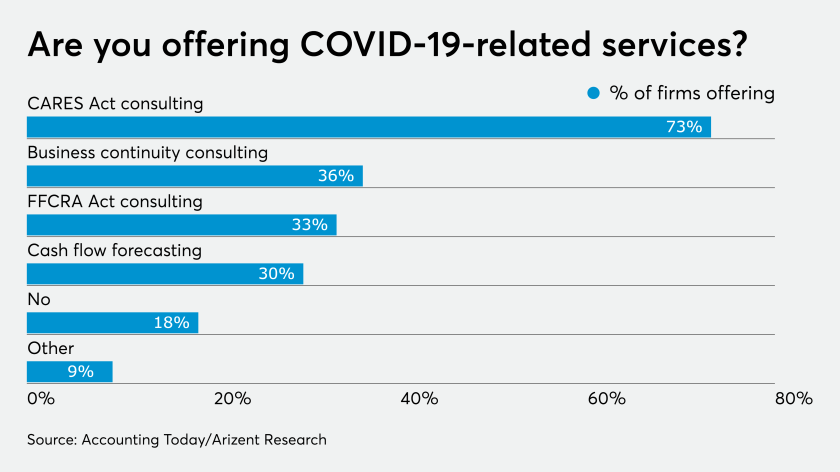

The coronavirus pandemic has opened up a number of specific areas with potential for the profession, according to leaders at the AICPA.

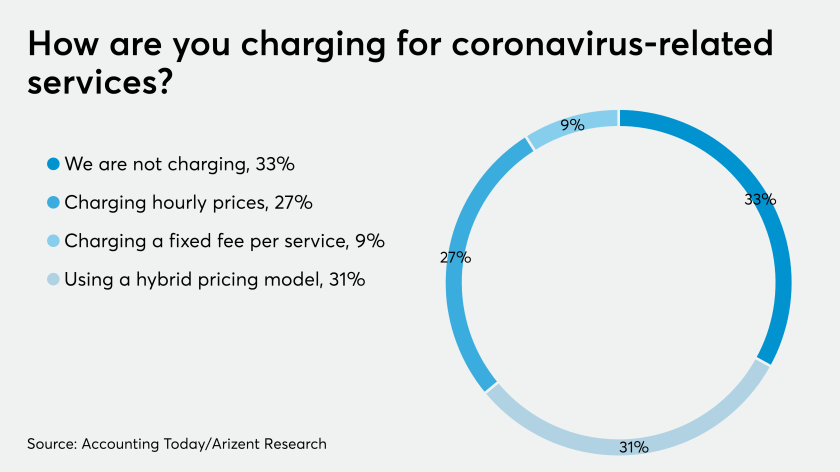

Firms may want to trade short-term cash for long-term goodwill.

The pandemic has created many great opportunities for finance pros to help their clients.

Gary Boomer, Allan Koltin and Gary Shamis share their top tips to help navigate the pandemic — and the uncertain period beyond it.

Highs, lows, curveballs and surprises are routine for every business, including accounting firms. Pandemics, however, are not routine (thankfully!). This crisis tests and provokes us all to the extreme.

Experts share what the profession has learned from COVID-19, from CPAs being ‘small businesses’ first responders’ to the inevitability of remote work.

Despite the coronavirus, firms can’t afford to stop looking for prospects