Among the pandemic-related issues covered are how to handle the Paycheck Protection Program and other stimulus efforts.

In today’s COVID-19 world where nothing seems normal, and “new normals” are popping up in every business operation, service businesses are trying to make up for lost income and rising expenses in creative ways that will lessen the financial impact of COVID-19.

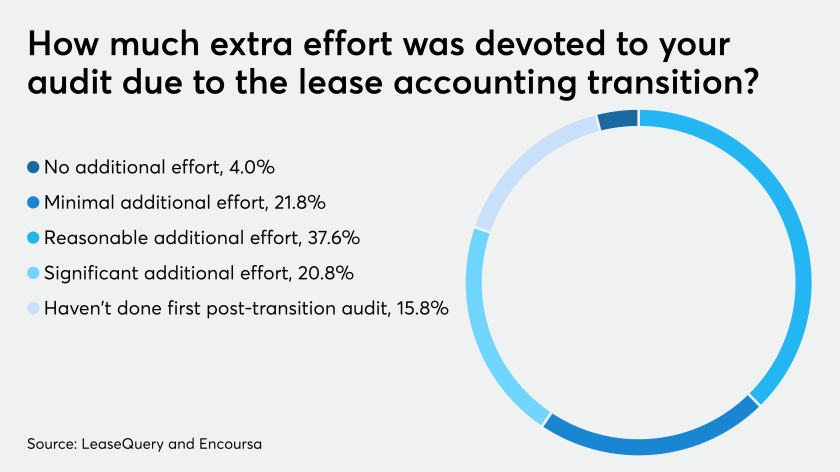

More than half the companies that completed their first audits under the new standard needed to make an extra effort.

The Institute of Internal Auditors and the International Federation of Accountants are calling on audit committees to be vigilant about risk management, performance, controls and processes during the COVID-19 pandemic.

Deloitte is helping its corporate clients get ready to prepare their quarterly financial statements in the midst of the novel coronavirus pandemic, as its own employees grow more accustomed to doing remote audits while working from home.

Audit firms can enhance the reliability of environmental, social and governance reporting, according to a new report from the Center for Audit Quality.

If you have an income of $1 million or more there’s less than a 1% chance that the IRS has called you in for an audit, according to new figures from the agency.

The IRS initiated 71 percent fewer corporate audits this spring compared with the same time period a year ago as the coronavirus pandemic halted many agency operations.

Hailee Johnson, a manager in UHY’s audit practice in Michigan, led a softball team sponsored by the firm to a World Series C Softball Championship in 2017, and she is hoping to do the same this year.

The pandemic is introducing changes — potentially significant ones — to the SOX compliance process.