Amid the economic and health wreckage the COVID-19 global pandemic has created, payments have stepped to the forefront in a way that has allowed banks, merchants and consumers to not only continue to do business, but also to increase communication.

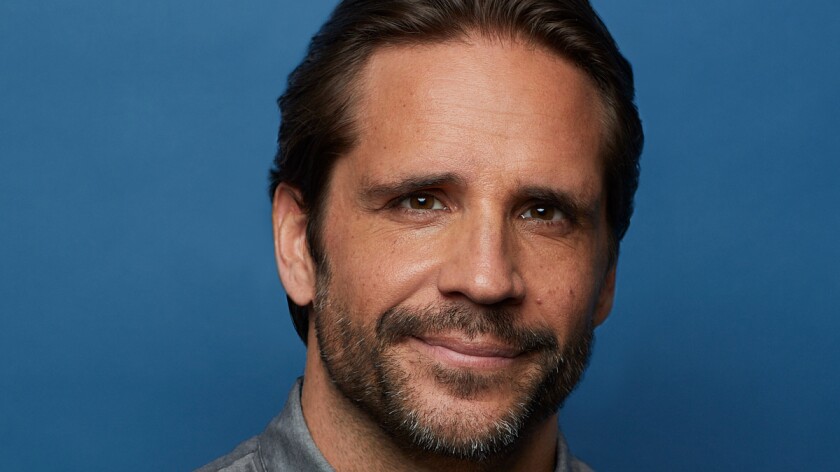

Bill Clerico created WePay during the last financial crisis, and sees a similar opportunity now. The coronavirus pandemic is affecting different markets in vastly different ways, and easing the flow of capital is just one way to provide help.

Three months ago, Stephen Squeri, the chairman and CEO of American Express, declared a global "economic free fall" due to the coronavirus. Its second-quarter earnings show how far a fall it has been.

The spending and account management capabilities of corporate prepaid cards have been given new purpose in a pandemic-struck world dependent on government and charity aid.

Inaccurate payments have plagued accounts payable and receivable departments from the time suppliers' contracts and invoices were stored in boxes and file drawers to the dawn of data-driven digital transactions.

Innovating is tough even in ordinary times, but during the coronavirus pandemic many payments startups had to dig into deeper reserves of creativity and resilience to meet expectations.

In the works for months, Mastercard Track Business Payment Service rolls out Tuesday with the goal of improving efficiency around corporate buyer and supplier payments at a time when these processes are uniquely constrained by the coronavirus pandemic.

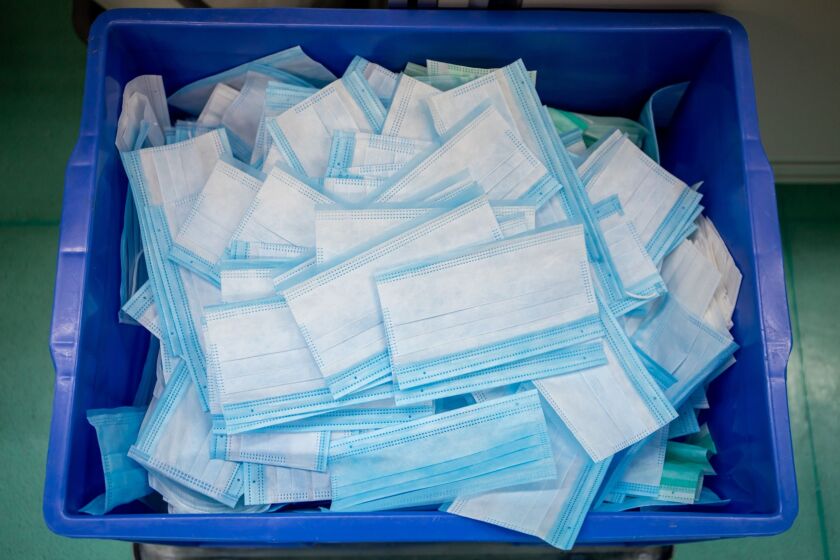

The shortage of personal protective equipment (PPE) for medical workers is one of the most troublesome elements of the coronavirus outbreak, though prior work to declutter cross-border supply chain payments provides some hope.

Due to the U.K.’s coronavirus lockdown, many British people are socially isolated in their homes, and rely on friends to get their groceries for them. They face the problem of how to reimburse people for their expenses, since cash is no longer acceptable.

Fast-moving payments innovation was already threatening comfortable connections between consumers and businesses before the pandemic turned the trend into an outright crisis.