They are under less pressure from policymakers to halt repurchase plans, but some have already hit the brakes and others may unofficially do so if the pandemic worsens.

Sen. Sherrod Brown of Ohio, the top Democrat on the Banking Committee, said financial institutions "need to be investing in their communities right now, not investing in their CEOs’ stock portfolios.”

Concerns about the economic fallout of coronavirus have mostly focused on supply chain disruptions. But fears are growing that weakening consumer demand could spark a recession.

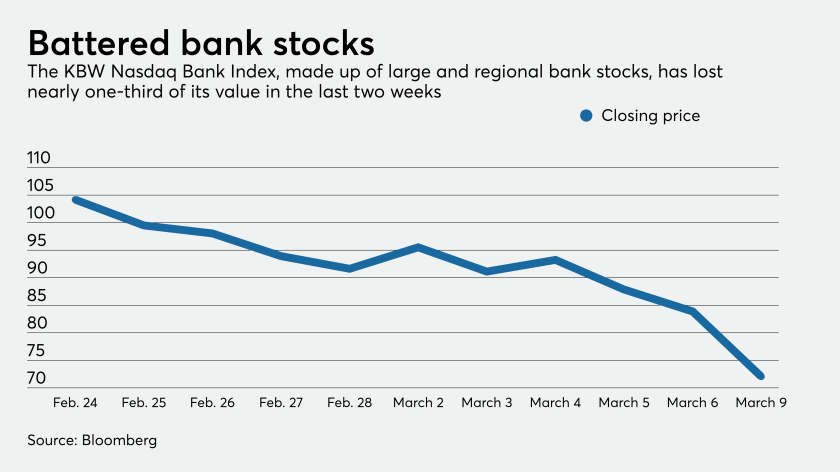

The bank agreed to pay $35 million to settle SEC charges it recommended high-risk ETFs to some customers; coronavirus fears continue to batter financial shares.

JPMorgan would consider buying other businesses; collectors would be allowed to pursue debt past the statute of limitations, if they warn borrowers.