Business continuity plans should be used constantly, not just when the crisis is at its peak, says the New York Fed’s head of financial services.

Finance execs are concerned about a new wave of infections leading to a further economic downturn, according to a survey Monday from PricewaterhouseCoopers.

As companies contend with the economic impact of the global pandemic and the related risks, management should be prepared for heightened auditor scrutiny.

Highs, lows, curveballs and surprises are routine for every business, including accounting firms. Pandemics, however, are not routine (thankfully!). This crisis tests and provokes us all to the extreme.

The Bonadio Group, a Top 100 Firm based in Rochester, New York, began returning to its offices this week as the stay-at-home order to combat the spread of the coronavirus was lifted in some parts of the state.

Business operations need cash influxes now more than ever.

As companies are evaluating continued operations, balancing profits with acceptable levels of loss, functioning with massively more remote work and trying to make up for economic disruptions, the first thought tends to be “How can we cut costs?”

The privately held firm recruited more than 160 reps in the first quarter on the strength of its balance sheet, CEO Amy Webber says.

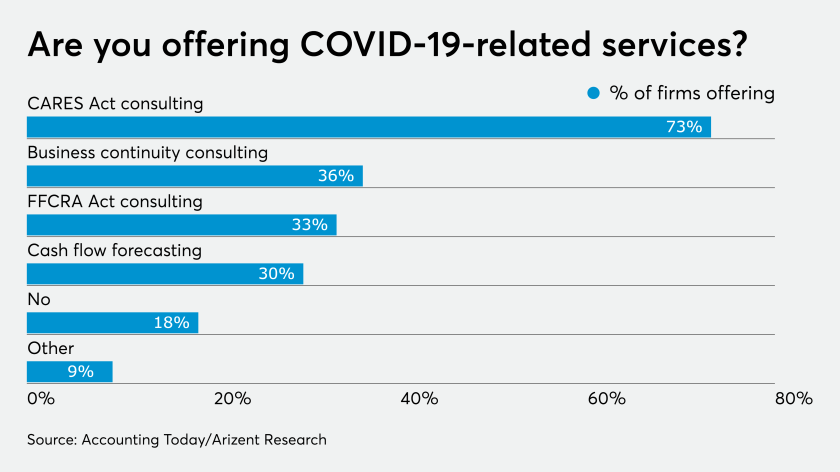

Financial advisors, broker-dealers, custodians and other firms are trying to do their part amid a public health and economic crisis.

My training in virology, laboratory pathology and emergency medicine gives me a different perspective of how to manage our society’s new path forward, writes M.D. and planner Carolyn McClanahan.