Some criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

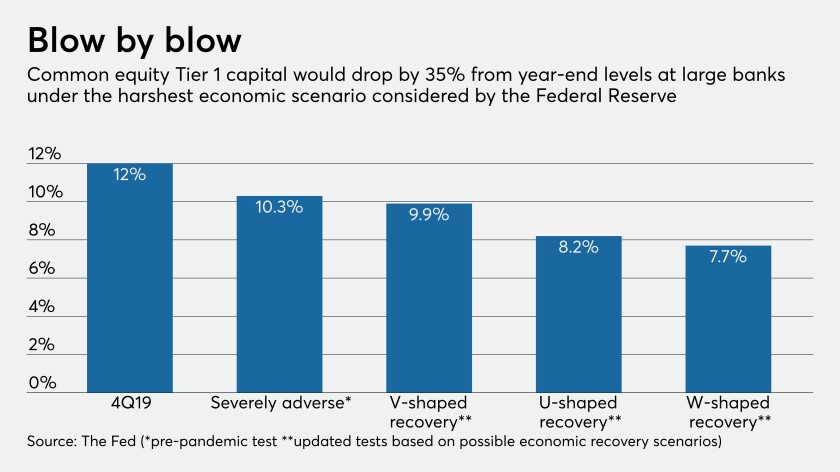

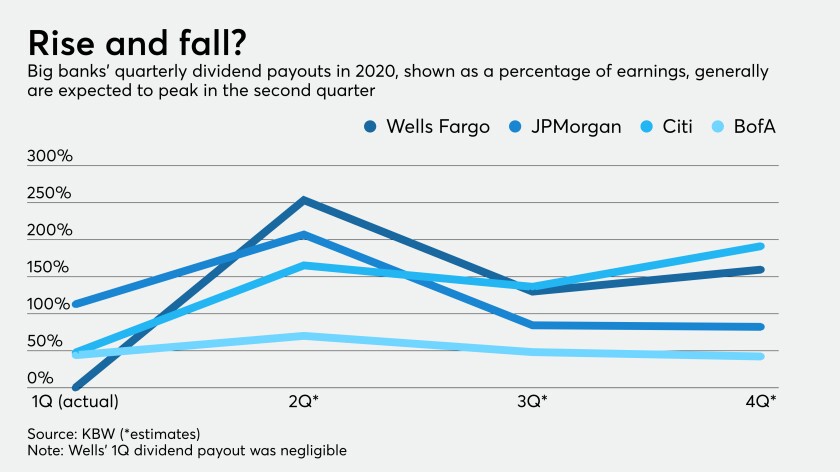

The Fed’s recent action capping dividend payments might prove inadequate once the coronavirus crisis really hits banks’ capital.

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

Payouts continue to be relatively generous, but that could change if the Federal Reserve demands banks bolster capital or the economy worsens.

The Ohio Democrat's criticism of Rodney Hood, chairman of the National Credit Union Administration, echoed complaints from bankers that the regulator was using the chaos from the pandemic to push through changes.

The agency's top supervisory official said the Comprehensive Capital Analysis and Review will proceed on schedule, and signaled that the Fed will look at how institutions are responding to fallout from the coronavirus.

The central bank will prioritize monitoring and outreach while reducing examination activity due to the coronavirus pandemic until at least the end of April.