Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

Some criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

The Fed’s recent action capping dividend payments might prove inadequate once the coronavirus crisis really hits banks’ capital.

The Fed has already eased certain capital requirements in response to the coronavirus pandemic. It should avoid making any further adjustments to the surcharge, which is meant to keep global banks from creating systemic risks.

In separate letters to Congress, the Fed asked for legislative action to ease Tier 1 capital minimums while the FDIC said it may use its own authority to address the market strain on banks.

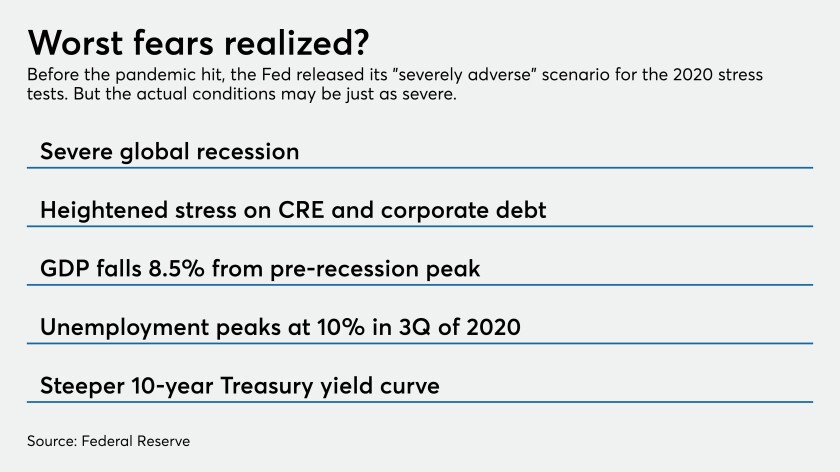

Many argue the economic turmoil from the pandemic makes the Comprehensive Capital Analysis and Review irrelevant this year, while others say testing banks’ capital strength is crucial now more than ever.

FHFA Director Mark Calabria said the health crisis will complicate the release of a proposal establishing new capital requirements for Fannie Mae and Freddie Mac.

Regulators issued a rule that gives banks the OK to dip into capital to help households and businesses cope with the economic impact of the coronavirus.

If banks are unable to weather the economic fallout from the outbreak, calls for more dramatic reforms could get louder.

![“We are delaying the opening of ... [the] comment period until we have some certainty on what the current overall situation is,” said FHFA Director Mark Calabria.](https://arizent.brightspotcdn.com/dims4/default/1bf0ad9/2147483647/strip/true/crop/4182x2787+0+0/resize/840x560!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F24%2F4f%2F09d186a142899167373b7d4166b7%2Fcalabria-mark-bl-031820.jpg)