- 5 Min Read

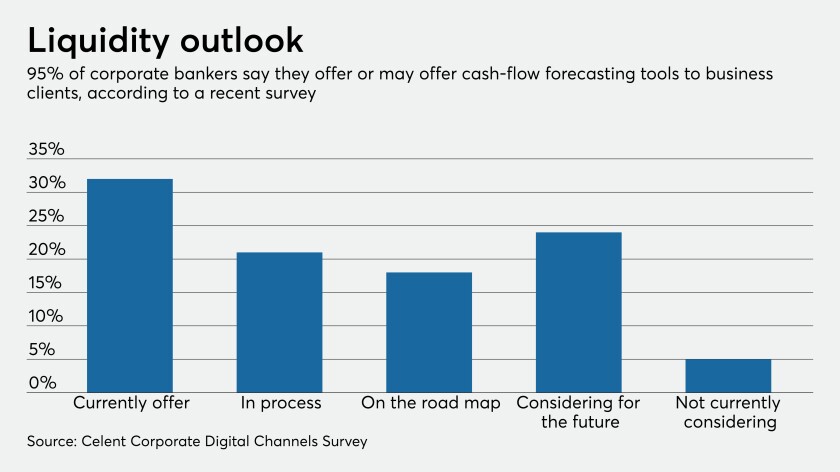

The global bank has rolled out cash-flow forecasting tools as financial institutions race to meet urgent demands from commercial customers trying to navigate uncertain times.

7 Min ReadSeveral companies said this week they’re slashing expenses as the economy limps along. Others would prefer to keep investing in new technologies and hold off on moves like branch closings to better gauge which changes in consumer behavior will stick.

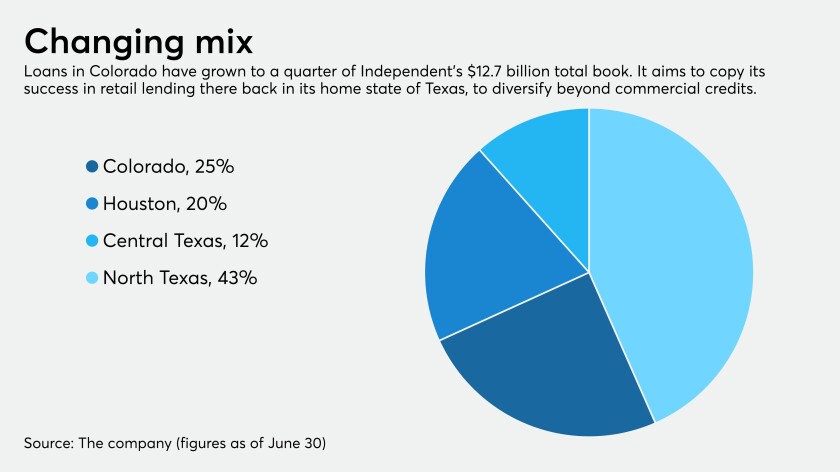

3 Min ReadNow that its deal with Texas Capital has been called off, Independent Bank in McKinney plans to scale back or exit some commercial lines and will seek to duplicate its retail banking successes in Colorado.

6 Min ReadBusiness owners are changing banks at three times normal levels, a trend researchers attribute to their difficulty in obtaining emergency loans. If the forgiveness stage of the Paycheck Protection Program proves arduous, that rate could climb much higher.

4 Min ReadA properly deployed combination of asset-based lending, commercial loans and investment banking is imperative in these circumstances.

5 Min ReadU.S. Bancorp, Wells Fargo, WSFS and others were already deeply engaged in digital transformations before the coronavirus crisis led them to pivot — quickly.

4 Min ReadConsumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

3 Min ReadLenders and government guarantors can use loan technology to bring immediate relief to business owners, former OCC official Jo Ann Barefoot says.

2 Min ReadOnline lenders can help the agency distribute loans faster as it gets set to deploy emergency funding to small businesses.

4 Min ReadMany banks are offering low-interest loans to help consumers and small businesses withstand the economic shocks of the pandemic. Some are also doing away with ATM, overdraft and late fees because, as one CEO put it, that revenue “is not the most important thing right now.”