- 4 Min Read

The coronavirus pandemic has exposed weaknesses even at well-established fintechs. They could become more resilient by partnering with traditional financial institutions.

3 Min ReadJelena McWilliams explains the agency's decision to enlist the help of tech innovators to modernize a reporting process that the coronavirus epidemic has exposed as outdated.

6 Min ReadBusiness owners are changing banks at three times normal levels, a trend researchers attribute to their difficulty in obtaining emergency loans. If the forgiveness stage of the Paycheck Protection Program proves arduous, that rate could climb much higher.

6 Min ReadWorried about a lack of demand and that some of their customers are ineligible, community banks are still on the fence about participating in the effort to back loans for businesses recovering from the pandemic crisis.

8 Min ReadPeoples Bank in Arkansas and Main Street Bank in Massachusetts are getting smarter about spotting suspicious transactions tied to unemployment benefit fraud as well as warning customers what to watch out for.

6 Min ReadAfter initially processing the loans manually, the Minnesota bank turned to "low code" software to build the electronic forms and workflows needed to approve loan applications. The result: a more than fivefold increase in the number of loans it could process in a day.

4 Min ReadJames Smith, who recently completed his gradual transition out of banking, was spearheading a public-private economic development plan for Connecticut when the coronavirus pandemic hit. The crisis made the need for the plan greater — and the job harder.

5 Min ReadDemand has soared for mental health services as bank employees put in long hours, supervise kids while working at home and endure personal crises. Citi, BofA, Fifth Third and others are getting creative to help them decompress during the pandemic.

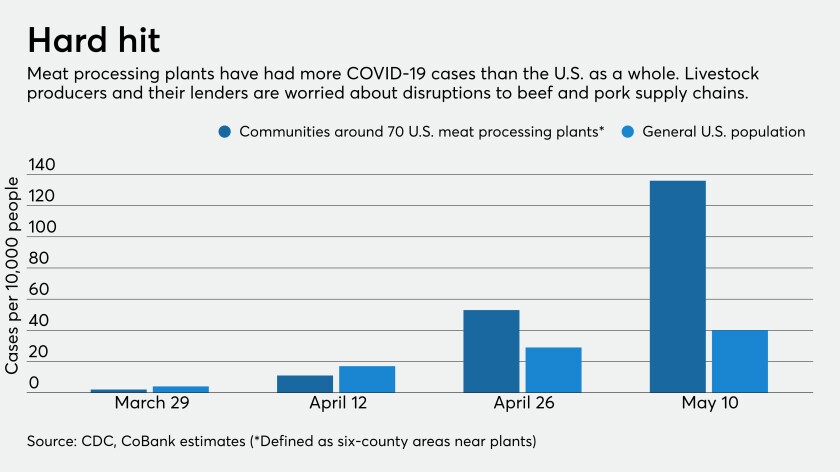

4 Min ReadLenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.

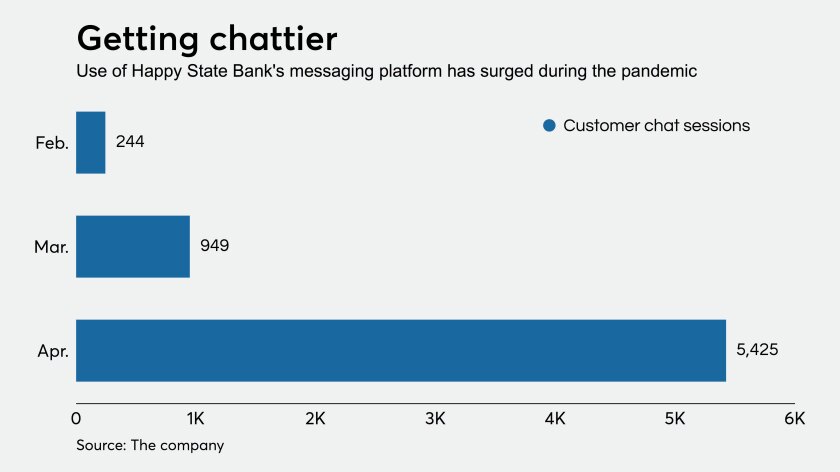

3 Min ReadThe Texas bank is leaning on solutions from Lightico and MANTL to quickly set up accounts and handle loans when customers can’t sign documents in person because of the coronavirus emergency.