Small businesses that had been experiencing steady job and wage growth prior to the outbreak of the coronavirus pandemic are seeing that situation change, according to figures from the payroll giant Paychex.

Customers are more reliant than ever on digital banking tools, and institutions like OceanFirst, BBVA and M&T are thankful they had invested in teaching employees to show customers how to use them.

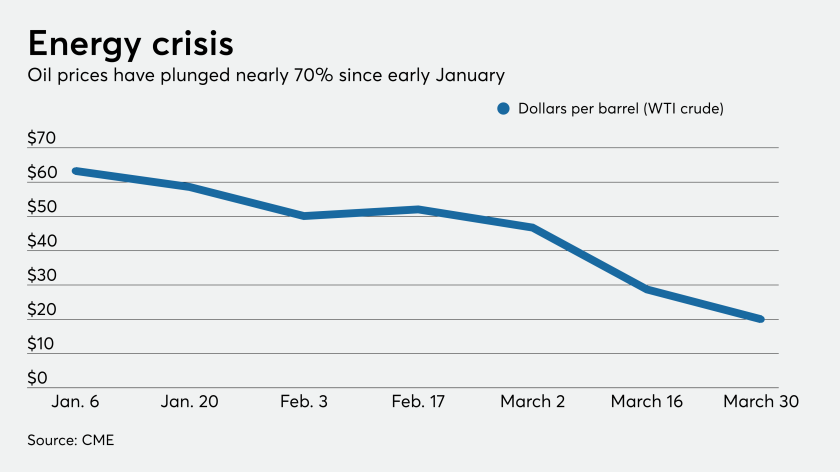

Weak demand for oil and gas, brought on by the economic fallout of the coronavirus outbreak, has raised concerns of energy firms missing loan payments or even going bankrupt. Here’s how banks and regulators are trying to get ahead of potential problems.

Municipal bond issuance was $67.88 billion after the first two months of 2020 and was on pace to easily eclipse the $400 billion mark — then COVID-19 completely turned the market upside down.

The ICBA chief’s plea for a six-month halt to regulations not related to the pandemic followed similar calls by community groups and a key Senate Democrat.

So far there have been over 200 COVID-19-related disclosures, according to Diver by Lumesis, a financial technology company.

One possible move is getting rid of the limit on state and local tax deductions, or SALT, that was part of the 2017 tax overhaul.

The regulation established standards for investors who own less than a quarter of an institution. Banks are getting more time for implementation as they focus on effects of the COVID-19 pandemic.

The Internal Revenue Service is now accepting email and digital signatures on tax documents to make it easier for tax professionals and taxpayers to communicate with the agency during the novel coronavirus pandemic.

With coronavirus driving more merchants to promote electronic payments over cash — and contactless payments over cards — many are still asking their customers to share a potentially virus-laden pen to sign a receipt or screen at the point of sale.