President Donald Trump said he wants to restore corporate tax deductions for business meals as restaurants reel from the impact of the coronavirus outbreak.

Card fraud risks — already soaring prior to the coronavirus outbreak — are changing rapidly as the pandemic deepens, forcing issuers and merchants to rethink protective measures.

Homeowners reeling from coronavirus-induced economic shock are already enduring extremely long wait times while trying to get relief. Legislation passed last week could worsen the logjams.

The real estate industry, struggling with coronavirus-linked limitations, got a boost with its sales business reclassified as an "essential" industry.

It doesn't appear that the slowing local and national economy has had much of an effect on the Missoula, Mont., real estate market yet, which has been a seller's market since the end of the last recession.

Mortgage technology efforts have historically been behind the curve, but some recent responses to the coronavirus highlight instances where it rises to the occasion.

The measure contains tax relief for both businesses and individuals, and other stimulus measures.

The operators of the venue argue that COVID-19's economic impact makes a $400 million expansion all the more important.

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

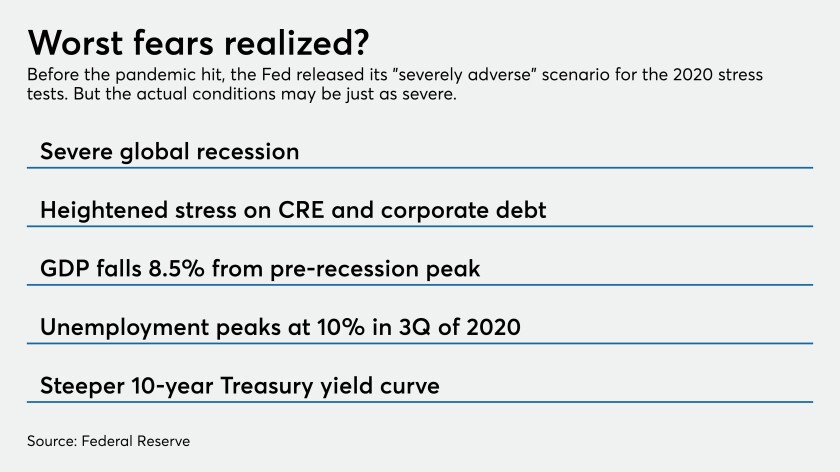

Many argue the economic turmoil from the pandemic makes the Comprehensive Capital Analysis and Review irrelevant this year, while others say testing banks’ capital strength is crucial now more than ever.