Corporate boards of directors are dealing with new problems in financial reporting and accounting.

One of the great challenges of working remotely is replicating the interactions and relationships that develop naturally in a physical office.

The Internal Revenue Service issued guidelines Wednesday scaling back a tax break for client entertainment, following through on an element of President Donald Trump’s 2017 tax overhaul that he has said he wants to reverse amid the virus pandemic.

The unemployment rate declined to 7.9 percent in September, the U.S. Bureau of Labor Statistics reported Friday.

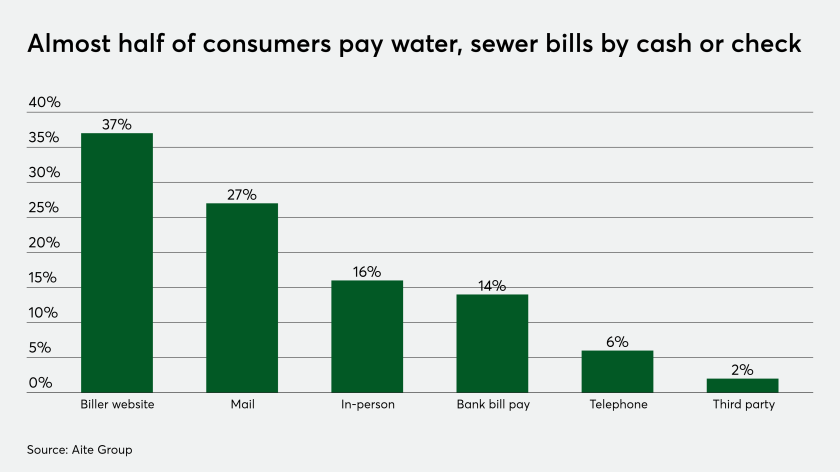

For many U.S. cities and counties, the high number of walk-in payments and checks typically received for services, permits and fees has been aggravating but acceptable — until coronavirus struck.

Under the proposed regulations, amounts paid for DPC arrangements and HCSMs are treated as deductible medical expenses.

A valued accountant is a holistic business advisor to clients, solving human problems that technology simply cannot — and will never be able to — solve on its own.

Here are seven best practices to boost your website’s efficiency and effectiveness.

There are signs of a slowdown in the economic recovery as the COVID-19 pandemic continued to spread.

Small-business employment and hours worked grew a bit in September, especially in the Northeast and within the construction industry, according to the latest monthly report from payroll giant Paychex.