Banks and credit unions should make it their top priority to pair with the central bank in distributing financial relief to small businesses, even if that means putting everything else on hold.

The spread of coronavirus requires employers to consider regulations that might not have applied before, and makes a strong case for teleworking.

The rating agency, citing severe ridership drops from COVID-19, dropped its rating to A-minus from A. It assigns a negative outlook.

In the face of the coronavirus, no accounting firm gets a pass from keeping in contact with clients and employees.

As companies move work off-site because of the pandemic, a host of issues have arisen around remote access, network monitoring and cybersecurity.

The regulation issued late on Tuesday directs state-regulated financial institutions to give mortgage borrowers at least 90 days of forbearance if they can show financial hardship resulting from the coronavirus pandemic. It also requires banks and credit unions to provide relief on ATM fees and credit card late payment fees.

The central bank will prioritize monitoring and outreach while reducing examination activity due to the coronavirus pandemic until at least the end of April.

Employers are seeing a spike in demand for EAPs and behavioral health workplace benefits.

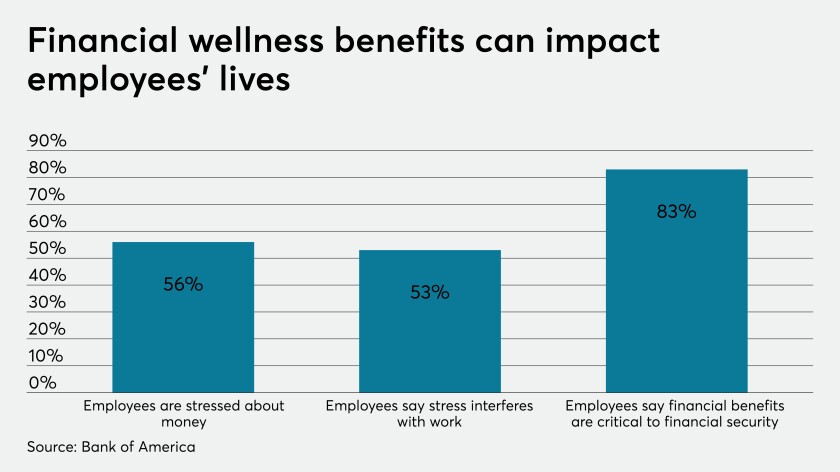

A financial planning expert from a Goldman Sachs team weighs in on choosing benefits, and communicating those concepts during COVID-19.

One thing they all agree on: It hasn’t cut their workload.