Financial institutions’ legislative agenda was already a low priority in Congress. Lawmakers’ efforts to stabilize the economy have shifted attention even farther away from bills that would benefit the industry.

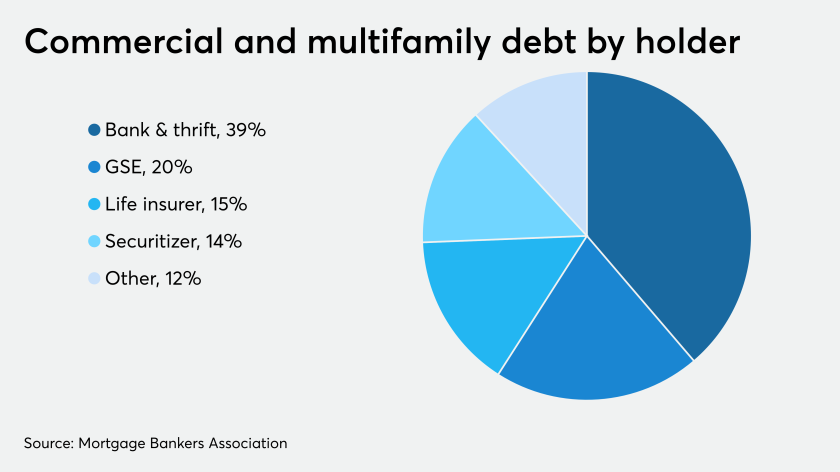

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

They are under less pressure from policymakers to halt repurchase plans, but some have already hit the brakes and others may unofficially do so if the pandemic worsens.

More than half of chief financial officers see the potential for a significant impact on their business operations, according to a new survey from PwC.

Advisors may find it difficult to connect with the people who need financial help the most.

First Horizon, Pacific Premier and South State are warning in regulatory filings that the pandemic could complicate deals that have not been completed.

The coronavirus card will include real-time updates from the Centers for Disease Control regarding support and testing.

The National Credit Union Administration also ordered its own employees to work from home until at least the end of March.

The Federal Reserve's most recent economic-stimulus effort could reduce disparities between a rally in Treasurys and a relative slump in mortgage-backed securities that contributed to higher average home-lending rates last week.

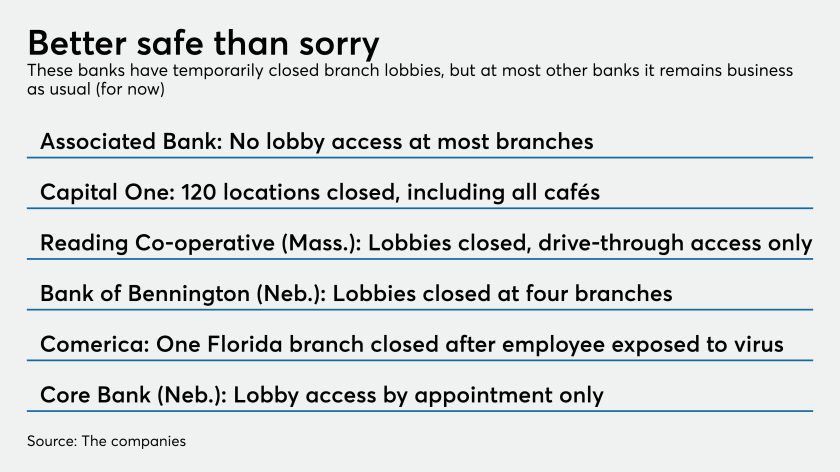

Many institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.