The Internal Revenue Service added six more forms to the 10 that support e-signatures.

EY earned a record $37.2 billion in the fiscal year ending June 30.

The Internal Revenue Service plans to mail out letters later this month to an estimated 9 million non-filers, encouraging them to claim their economic impact payments by an Oct. 15 deadline.

COVID-19 has created new challenges and a remote work environment that heightens the risk of fraud at public companies.

Accounting firms are still managing to see increases in their fees and income per partner this year, despite the economic downturn from the COVID-19 pandemic, according to the latest edition of the annual Rosenberg Survey.

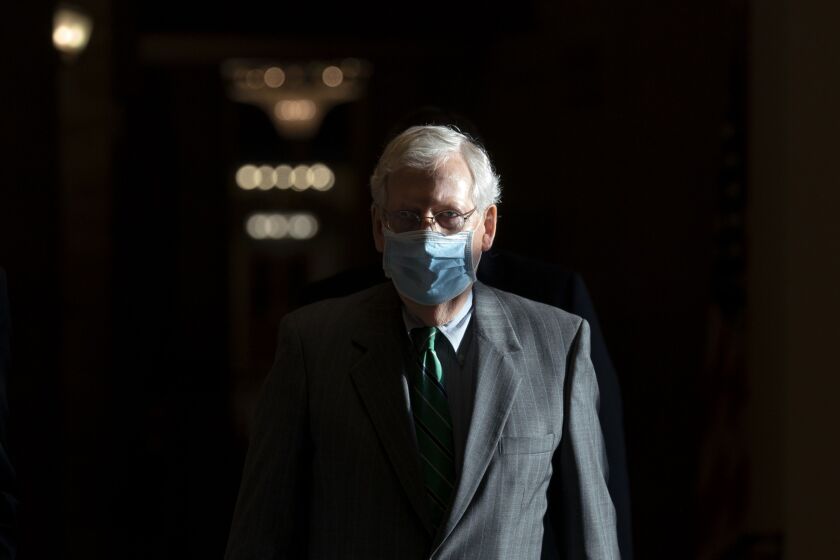

Senate leaders will be trying to hold their parties together for a vote Thursday to advance a slimmed-down stimulus bill that Democrats have already rejected, with both sides jockeying for advantage in public perceptions two months before the election.

Accounting professionals who embrace a willingness to adapt are the ones more likely to emerge successfully from today’s volatile market.

An engaging presentation in the online world is quite different than in live events.

ADP's Pete Isberg explains what we know about payroll tax deferral -- and what we don't.

Democrats on the tax-writing House Ways and Means Committee introduced a bill to overturn President Trump’s executive action to defer payroll tax contributions, along with a resolution of disapproval that’s being coordinated with Democrats in the Senate.