The House and Senate are set to vote Monday on $900 billion in pandemic relief aimed at boosting the U.S. economy into the early spring, combined with $1.4 trillion to fund regular government operations for the rest of the fiscal year.

Bank and credit union groups are pushing to include the industry’s front-line workers in the next priority group, but even as a recommendation is coming soon from a CDC advisory panel, the decision ultimately will be made state by state.

Lawmakers are seeking to address some of the PPP’s more obvious failings in the latest coronavirus bill.

Noninterest income has bolstered profits this year. But its growth is expected to slow over the next two years, making for a gloomy earnings outlook unless vaccine distributions and the economic recovery are relatively swift.

Fraud is continuing to increase this year, in part due to the COVID-19 pandemic, according to a new survey by the Association of Certified Fraud Examiners.

The Internal Revenue Service is extending until June 30, 2021 the period in which it will accept digitally signed and emailed documents due to the COVID-19 pandemic.

EAPs, yoga and meditation classes and access to free therapy are all ways to help your employees combat stress and anxiety from the on-going pandemic.

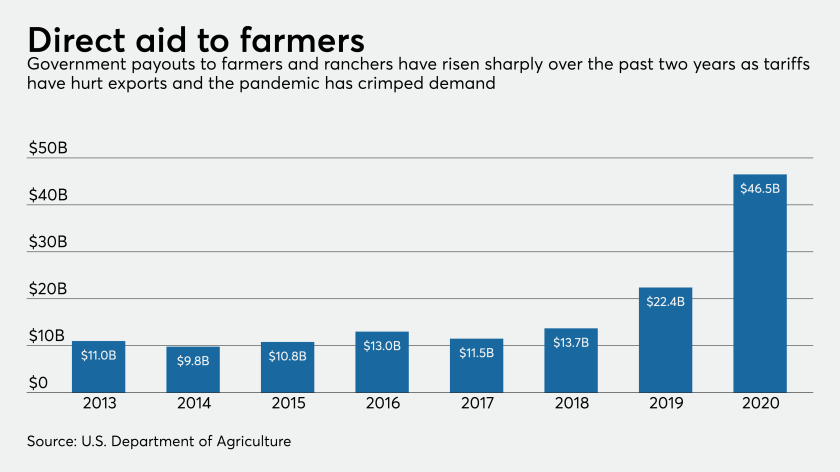

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.