The spending and account management capabilities of corporate prepaid cards have been given new purpose in a pandemic-struck world dependent on government and charity aid.

The governor largely agreed to abandon the steep cuts he proposed in his revised budget,.

The ratings on the Louisville, Kentucky's KFC Yum! Center bonds were lowered to BBB-plus by S&P because of expected operational difficulties.

The Office of the Comptroller of the Currency will use year-end 2019 asset totals in its calculating its next assessment, saying national banks "should not be penalized" for adding emergency loans to their books during the pandemic.

Tax pros share what they’re telling clients about relief for the jobless during the pandemic.

In a new twist on an old scam, cybercriminals have tried to get thousands of people to surrender their Wells bank account information by sending authentic-looking emails containing malicious links that lead to a fake website bearing the company's name.

The Trump administration, following a backlash, said it would release details about companies that received loans of $150,000 or more from a coronavirus relief program for small businesses.

Business owners are changing banks at three times normal levels, a trend researchers attribute to their difficulty in obtaining emergency loans. If the forgiveness stage of the Paycheck Protection Program proves arduous, that rate could climb much higher.

It’s a good time to be opportunistic about your firm’s future — and to poke these embers in a meaningful way.

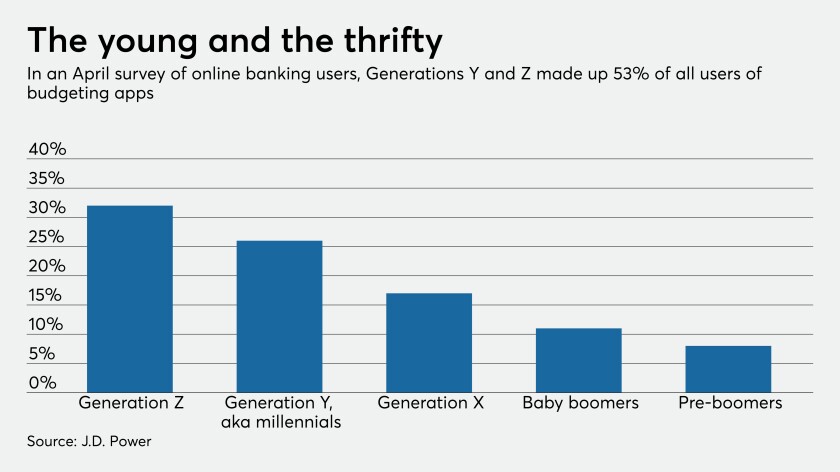

With money flow suddenly stifled for millions of customers, demand for money management tools has skyrocketed.