The lender portal for the Federal Reserve’s Main Street Lending Program has opened as the long-awaited alternative to the problem-plagued Paycheck Protection Program after weeks of delays.

The coronavirus’ economic fallout has drawn more attention to buy-now-pay-later options, leading to fresh creativity in business models and marketing.

Some multinational companies can generate additional carryback tax loss relief through transfer pricing planning.

The online lender quickly built an app for ride-share drivers with much of their information already filled in.

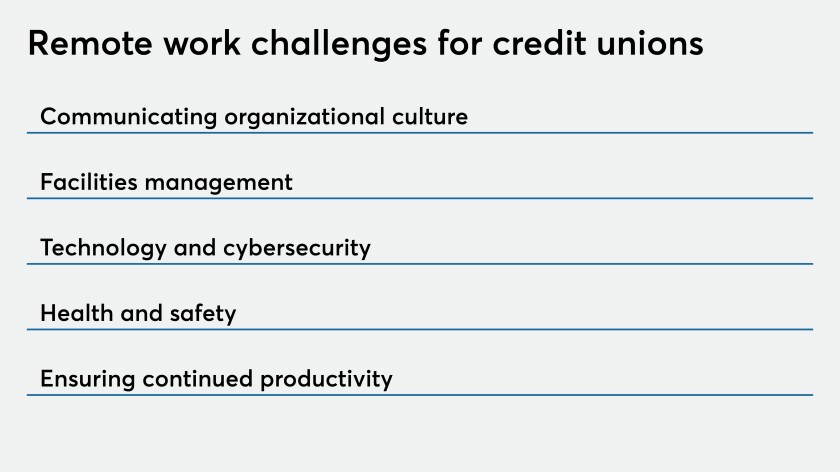

Some of the industry’s biggest institutions intend to keep a significant portion of their staff working from home indefinitely. That’s raising new questions about organizational cultures and how to appropriately utilize credit union facilities.

Gary Boomer, Allan Koltin and Gary Shamis share their top tips to help navigate the pandemic — and the uncertain period beyond it.

The IRS and the Treasury gave tax relief to businesses and investors who were engaged in New Markets Tax Credit transactions but couldn’t get them done in time due to the COVID-19 pandemic.

Peoples Bank in Arkansas and Main Street Bank in Massachusetts are getting smarter about spotting suspicious transactions tied to unemployment benefit fraud as well as warning customers what to watch out for.

The Wisconsin health system's ratings have weathered the early impact of COVID-19 on its balance sheet, although S&P revised its outlook to negative.

Finance execs are concerned about a new wave of infections leading to a further economic downturn, according to a survey Monday from PricewaterhouseCoopers.