Latin America is seeing a surge in digital wallet adoption as governments seek ways to disburse coronavirus aid to vulnerable citizens, and consumers look for safe alternatives to cash.

Inaccurate payments have plagued accounts payable and receivable departments from the time suppliers' contracts and invoices were stored in boxes and file drawers to the dawn of data-driven digital transactions.

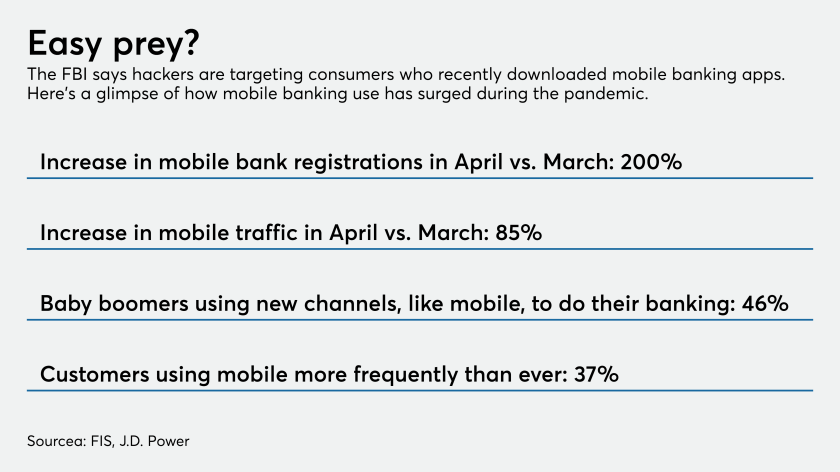

Mobile banking use has swelled since the pandemic hit, and law enforcement officials expect hackers to target the credentials of digital novices. The FBI stressed the importance of two-factor authentication and ensuring consumers know how to spot fake apps that carry malware.

The Volunteer State reported a nearly 16% decline in revenues in April, much of which was due to stay-at-home orders and delayed tax filings.

The Governmental Accounting Standards Board released a proposed technical bulletin Thursday from its staff with application guidance on the CARES Act and outflows incurred by state and local governments in response to the COVID-19 pandemic.

After three months of supervising national banks remotely, examiners will soon resume visiting them in person and working in regional offices, says acting Comptroller of the Currency Brian Brooks.

In the midst of a global pandemic, the gravitational pull toward digital transactions has been amplified.

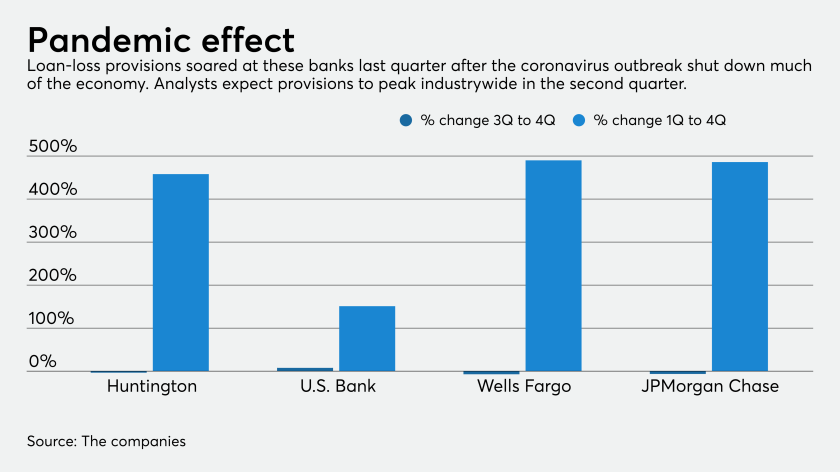

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

The acting head of the agency says it cannot continue relying on web-based exams put in place during the coronavirus and will start sending staff into banks.

The immediate lockdown of the nation’s economy in response to attempts to flatten the coronavirus infection curve has had a widespread impact on the revenues of all businesses, particularly small ones that are more susceptible to economic disruptions.