The Financial Accounting Standards Board released an accounting standards update providing a one-year effective date delay for private companies and organizations to apply the revenue recognition and leases standards due to COVID-19, although they still have the option to apply the standards early.

Two years ago, the Tulsa, Okla., company expanded its Native American casino lending business nationwide. It seemed like a great plan until the coronavirus pandemic struck.

Comptroller Kevin Lembo forecast a $620 million fiscal 2020 deficit in his monthly update to Gov. Ned Lamont.

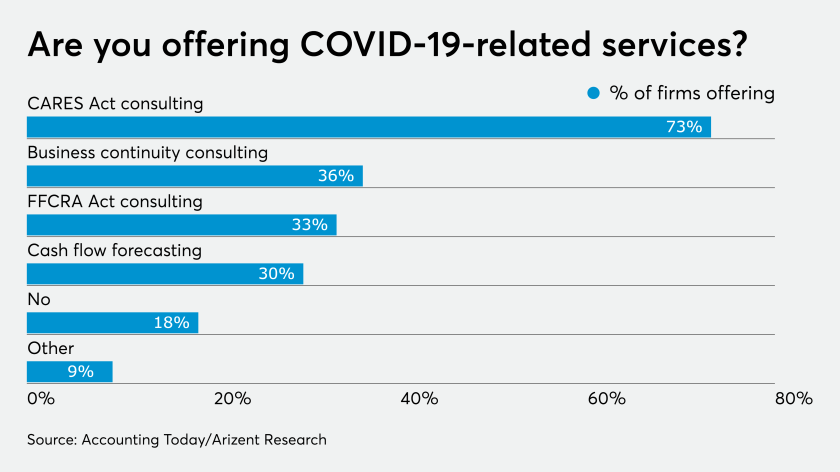

Highs, lows, curveballs and surprises are routine for every business, including accounting firms. Pandemics, however, are not routine (thankfully!). This crisis tests and provokes us all to the extreme.

Innovating is tough even in ordinary times, but during the coronavirus pandemic many payments startups had to dig into deeper reserves of creativity and resilience to meet expectations.

Private sector employers slashed at least 2,760,000 jobs from April 12 to May 12, according to payroll giant ADP, on top of the 20 million job cuts in the previous monthly period.

These videoconferencing best practices will significantly boost your remote-communication game.

Many of the payment innovations of the past decade got an early start in Canada, building a base of users and habits the nation hopes will make the pivot to post-coronavirus commerce easier than other markets.

The CARES Act included several provisions allowing companies to claim net operating losses for past tax years, temporarily reversing some of the limitations in the Tax Cuts and Jobs Act.

The National Association of Tax Professionals will hold an online education event, featuring live interaction with accounting instructors, attendees and exhibitors, July 27-31, 2020.