The latest update adds a loan forgiveness estimator and PPP-specific reports to QuickBooks Online, among other tools.

U.K. fintechs are using their technology to assist British businesses and consumers during the coronavirus pandemic by helping banks disburse emergency business loans, enabling e-commerce merchants to offer installment payments to consumers, and giving employees access to salary advances.

Even after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

Bill Smith, managing director of the National Tax Office of CBIZ MHM, discusses the loan forgiveness provisions of the PPP, along with the employee retention credit, net operating loss carrybacks and economic impact payments, along with the prospects for the next round of stimulus in Washington.

The Bonadio Group, a Top 100 Firm based in Rochester, New York, began returning to its offices this week as the stay-at-home order to combat the spread of the coronavirus was lifted in some parts of the state.

The takeaway from the PPP rollout is that bankers must protect their reputations and limit their risk appetites as they participate in further government-backed rescue programs.

The act increased many of the limits from the Tax Cuts and Jobs Act, and the IRS has offered more guidance.

As Erez Ben-Kiki and his wife tried to move her yoga business online — conducting classes via Zoom — they discovered that the process of monetizing such classes was surprisingly awkward. Ben-Kiki, CEO and co-founder of 2Key Network, spotted a gap in the market.

The Federal Reserve Bank of Boston published details on the terms for lenders and borrowers to participate in the facility intended to provide coronavirus relief funds to middle-market firms.

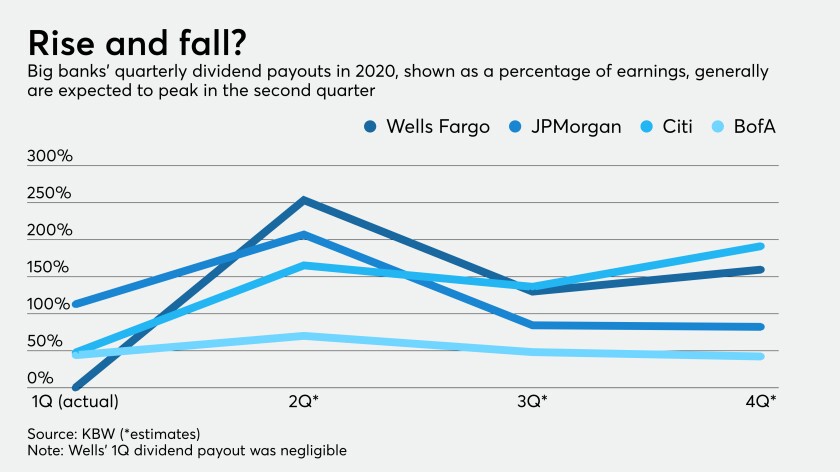

Payouts continue to be relatively generous, but that could change if the Federal Reserve demands banks bolster capital or the economy worsens.