From more OICs and higher state taxes, to managing NOLs and the long-term ramifications of the PPP, experts advice predictions for practitioners.

Like a lot of operations, such as small businesses, hospitals and suppliers, St. Joseph Episcopal Church in Queens Village, N.Y., found out it was not as “online” as it thought.

Pandemic-induced market volatility and warnings from Wall Street that tax rates are bound to rise have more Americans preparing to move money from traditional individual retirement accounts into Roth IRAs.

This year all playbooks have to be discarded and a fresh start needs to be developed.

Demand has soared for mental health services as bank employees put in long hours, supervise kids while working at home and endure personal crises. Citi, BofA, Fifth Third and others are getting creative to help them decompress during the pandemic.

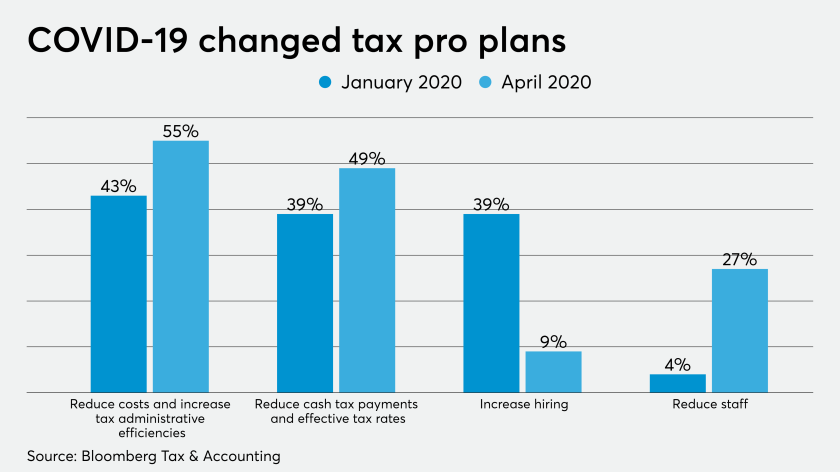

The COVID-19 pandemic is forcing corporate tax departments to reconsider their top priorities for this year, according to a new survey.

A bipartisan group of lawmakers has introduced legislation to close a loophole in the CARES Act.

If the agency hadn’t revised the 1977 law now, nothing would be done for communities in need that are struggling even more in the coronavirus pandemic, writes Faith Bautista, CEO of the National Diversity Coalition.

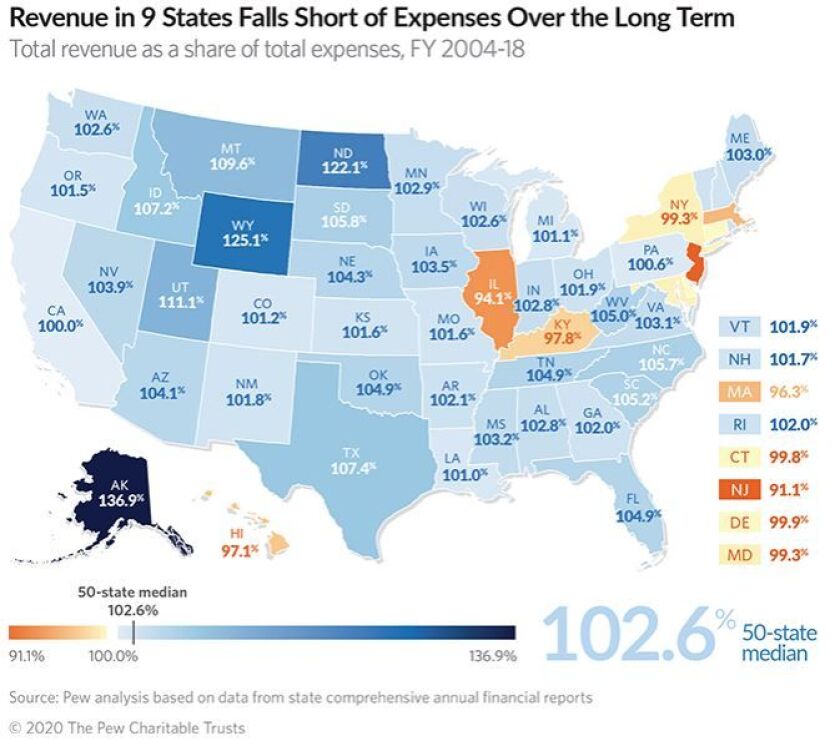

As state finances across America are upended by the coronavirus, almost all of them face the same, self-imposed, problem: how to balance their budgets.

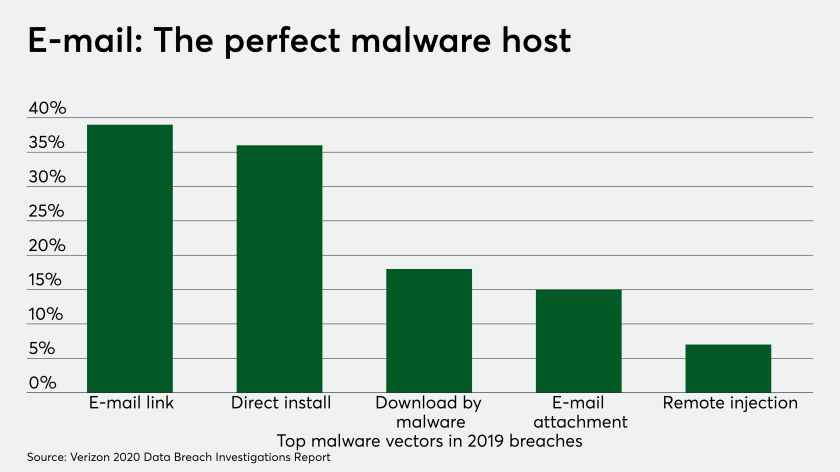

Fraudsters are licking their chops at the prospect of businesses and financial services extending remote working because of the coronavirus pandemic.