For families who employ a nanny to care for their children in the home, there is the extra concern of what to do with their employee.

Congress should pass legislation authorizing use of nontraditional data sources to make credit more available to consumers who’ve taken a hit from the coronavirus pandemic.

The request for a second municipal lending facility was made in a bipartisan letter sent to the Fed last week by four senators.

But relatively few audit execs are actually performing reviews of critical risk areas such as health and safety.

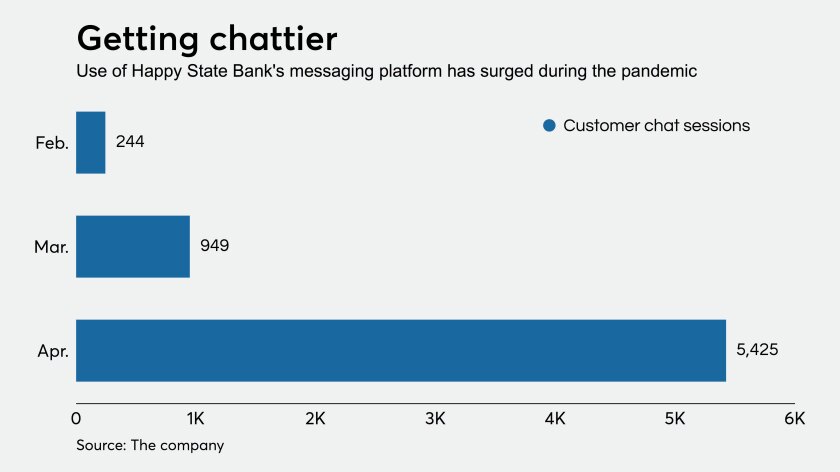

The Texas bank is leaning on solutions from Lightico and MANTL to quickly set up accounts and handle loans when customers can’t sign documents in person because of the coronavirus emergency.

As companies are evaluating continued operations, balancing profits with acceptable levels of loss, functioning with massively more remote work and trying to make up for economic disruptions, the first thought tends to be “How can we cut costs?”

The application from the Treasury leaves many questions unanswered.

The Internal Revenue Service and the Treasury Department are beginning to send nearly 4 million economic impact payments by prepaid debit card, instead of by paper check or direct deposit.

Crowe has joined the growing number of firms offering solutions to aid in Paycheck Protection Program participation.

The $43 billion deal was one of a series of payment mergers in 2019 that were designed to combine bank technology and merchant acquiring across multiple markets and industries while warding off ascendant fintechs offering fast access to digital payments and working capital.