Even before the coronavirus outbreak, cybercriminals were shifting their attention away from point-of-sale terminals — but the retail industry still absorbs the most attacks seeking to compromise databases or networks.

U.S. Bancorp, Wells Fargo, WSFS and others were already deeply engaged in digital transformations before the coronavirus crisis led them to pivot — quickly.

The Ohio Democrat's criticism of Rodney Hood, chairman of the National Credit Union Administration, echoed complaints from bankers that the regulator was using the chaos from the pandemic to push through changes.

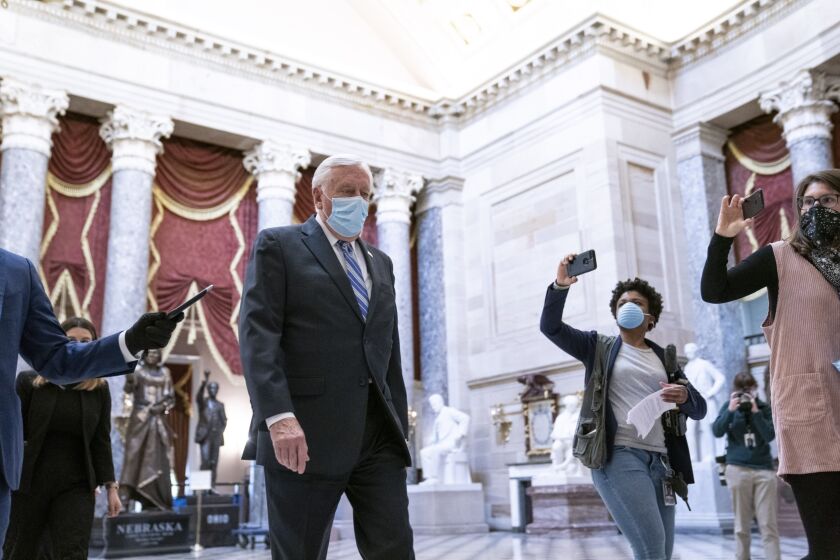

House Democrats proposed a $3 trillion virus relief bill Tuesday, combining aid to state and local governments with direct cash payments, tax breaks, expanded unemployment insurance and food stamp spending as well as a list of progressive priorities like funds for voting by mail and the troubled U.S. Postal Service.

Padgett Business Services’ Roger Harris suggests some exceptions for employers with fewer than 50 staff.

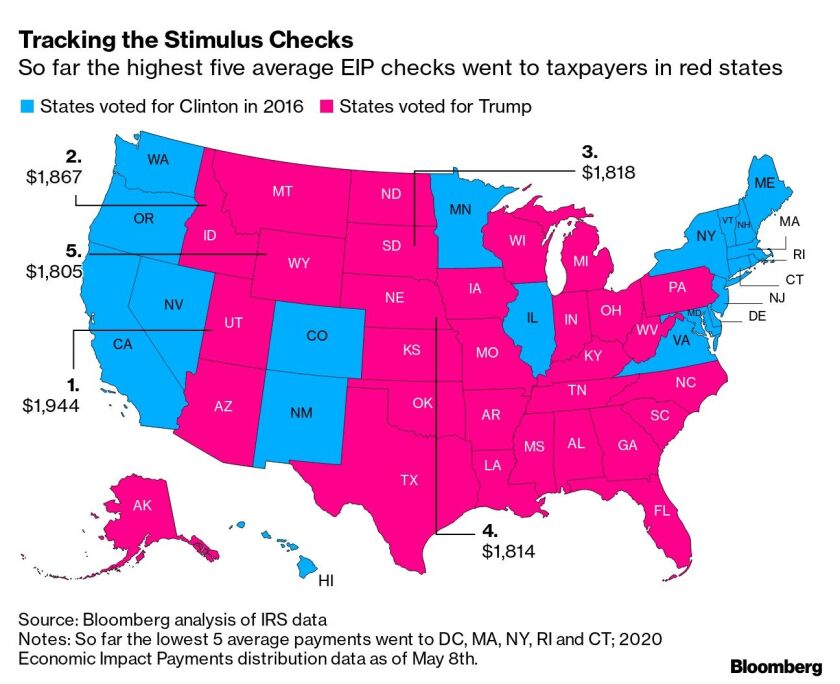

The proposal would give a safe harbor to financial institutions that work with cannabis companies in states where the substance is legal. But the bill, which would direct $3 trillion in aid to struggling households, businesses and local governments, faces long odds in the Republican-controlled Senate.

Residents of states such as Utah, Idaho and South Dakota collected average stimulus payments topping $1,800.

More than four out of five states needed supplemental appropriations, rainy day funds or fiscal reserves to meet coronavirus challenges.

The IRS is extending the claims period for health care flexible spending arrangements and dependent care assistance programs and enabling taxpayers to make mid-year changes to their accounts.

More issuers are missing bond payments and deadlines for filing annual financials; the Roman Catholic Church of the Archdiocese of New Orleans filed for bankruptcy partially blaming COVID-19, affecting $41 million of bonds.